Private Equity – time to raise the bar

Medline Industries, a healthcare supplier business, confirmed on the 5th June that it had been bought out by a private equity club in a USD 34bn deal. The private equity groups want to support Medline’s expansion plans.

- Among the groups involved in the acquisition of Medline are Blackstone (NYSE: BX), Hellman & Friedman, and Carlyle (NASDAQ: CG). The Medline deal was the largest deal made by a consortium of private equity groups since the 2007 financial crisis.

- Medline Industries is one of the largest US manufacturers of medical supplies. The company was founded in 1966 by the Mills family. The Mills family will continue to run the business as its main shareholders.

- Private equity club deals started regaining relatively recently – these types of deals were fashionable before the 2007/8 financial crisis but came to a halt as a result of that crisis.

A club deal refers to a private equity (PE) buyout where a consortium of private equity firms partner to acquire a company. It allows PE firms to collectively acquire high value companies they normally could not afford and spread the risk among the participating firms.

According to Pinsent Masons, a multinational law firm, the total value of UK private equity club deals reached GBP 19.7bn in 2020, up 4x from GBP 4.5bn y/y.

There were 56 deals in 2020, up 30% from 43 y/y (Private equity wire, 2021).

One of the biggest club deals post the 2007 financial crisis has been ASDA’s acquisition by the Issa brothers and TDR Capital in October 2020 for GBP 6.8bn (the deal was completed in mid Feb 2021 and the UK Competition & Markets Authority set out provisions for approval of the deal on 17th May 21).

LBO deals are generally used to access capital in order to execute a limited number of strategies – cost cutting, reorganisation, new or accelerated development of products or technologies of well-established companies – such as Medline Industries.

Club deals allow the PE buyers to use lower levels of debt financing. Sellers will typically look more favourably on a purchaser that does not have to arrange a large debt financing to complete the deal.

In spite of the obvious attractions to buyers and sellers of laying off various types of deal risk, club deals have not been universally successful.

- Toys “R” Us – a club deal executed by Bain, KKR & Co. Inc (NYSE: KKR), and Vornado (NYSE: VNO) in 2005 was acquired at a 120% premium – the PE club then loaded the Toys “R” Us balance sheet with an approximate additional USD 3bn of debt, taking Toys “R” US debt from ~USD 1.9bn to over USD 5bn, directly after the acquisition.

According to Bloomberg, Toys “R” Us’ interest expenses burnt 97% of the company’s operating profits by 2007. Within 10 years Toys “R” Us was bankrupted by the deal, leading to the closure of 7k stores and the loss of 50k jobs. (The Atlantic, 2018).

Toys “R” Us lost financial flexibility (most cash flow going out to interest payments) and could no longer raise equity to innovate. There were also significant cultural changes as a result of PE ownership and the debt burden, almost certainly driving out the most talented employees who could relatively easily find employment elsewhere.

- Texas’ largest utility, TXU was acquired in 2007 by KKR, TPG, and Goldman Sachs Capital Partners (amongst others) for USD 48bn, a deal financed by USD 40bn of debt – making it the biggest LBO bet in history.

The TXU club deal failed due to the impact of ‘The Great Recession’ (2007/8 financial crash) on natural gas prices and the rise of the US fracking industry. TXU has previously delivered highly attractive share price growth by aggressively raising prices and building out coal fired power stations.

Fracking and the 2007/8 financial crash made the price rise strategy untenable and combined with the new debt loaded onto the balance sheet by the PE club, a highly successful company from an investor perspective was forced into bankruptcy by 2012. Equity holders lost 95% of their investment.

Most of the failures related to the PE club deal failures are, at the top level, related to the failure to be able to service the debt burdens introduced by the PE clubs.

The underlying factors that lead to an inability to service debt and over which PE clubs have control and influence, in our view, are related to:

- Change of culture

- Loss of talent

- Inability to innovate

- Change of focus from investment in growth to cost cutting

- Decisions by outside LBO investors that have failed to properly understand the businesses acquired

- Necessity of PE club members to compromise over strategy and tactics

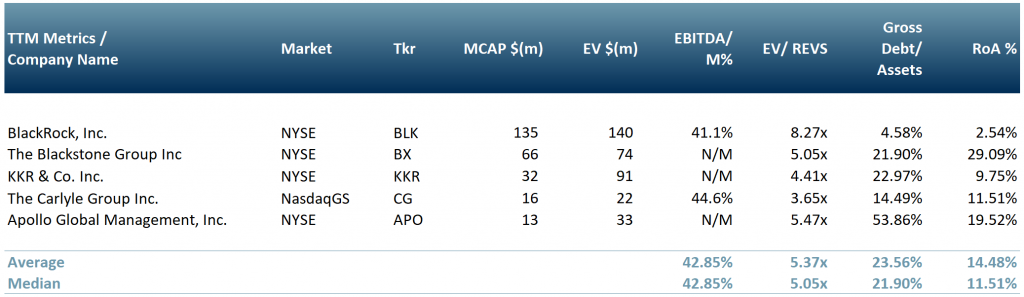

Exhibit 1 – Peer group table of the public investors that partner in PE club deals

Source: ACF Equity Research

Source: ACF Equity Research

Factors over which PE clubs have little direct or no control:

- Global economic shocks – e.g., the 2007 and C-19 financial crisis

- Sector sensitivity to economic change – the impact of Covid-19 on the economy has caused some lenders to exercise more caution when it comes to backing PE club deals in the sectors most affected by lockdowns

- Regulation and deal size

It is difficult to identify practical solutions to reduce PE club failures, but it is likely that if PE firms faced a higher risk profile themselves there would be far fewer club deals leading to bankruptcy of the deal target company. The other solution appears to be to regulate these types of deals out of practical existence.

Regulation may turn out to be necessary, but a more favourable solution would be for the PE industry to raise its overall game.

Authors: Anda Onu and Christopher Nicholson – Anda is part of ACF’s Sales & Strategy team, Christopher is ACF’s Head of Research. See their profiles here