Recycling our waste into energy (WTE)

Yarra Valley Water built a Waste to Energy plant in 2017. The facility processes waste into renewable energy, supporting the environment and saving costs.

- Yarra Valley Water, one of Melbourne’s (Australia) largest water corporations, developed its first waste to energy (WTE) facility based in Wollert (North Melbourne). Wollert processes 33,000 tonnes of commercial food waste per year.

- The emissions reduction from the Yarra WTE facility vs. the production of traditional electricity production is the equivalent of removing ~45,000 cars from the road in Victoria, Australia for a whole year. By way of a further example, the Wollert facility can produce 22,000 kW per day, which is the equivalent power demand for 1,300 homes (up to 8,030,000 kW annually).

- Since 2017, the WTE facility has reduced Wollert’s costs (Using the electricity the WTE facility produces to power its Headquarters, water and sewage facilities) and generated over A$8m in revenues (selling excess electricity to the grid),

- Yarra Valley Water’s waste to energy facility, powers itself along with its nearby sewage and recycled water treatment plant. The facility generates 70% excess energy, which can be sold to the electricity grid.

- Yarra Valley Water has partnered with >20 businesses that provide food waste that is used to power the facility and announced the construction of a second waste-to-energy facility with a greater capacity than Wollert. The second WTE facility, Lilydale, will process ~50,000 tonnes of food waste annually and generate 33,000 kW per day (up to 12,045,000 kW annually).

For now, the main types of waste accepted by these WTE facilities are: Fats (oil and grease); Fruit and vegetable waste; waste from animal processing facilities; Restaurant, catering food wastes; and lastly Brewery and dairy wastes. Turning these wastes to energy is environmentally supportive.

Environmentally supportive business models are increasingly popular with both institutional and retail investors (ESG).

The strong and growing emphasis on ESG within the investment community means the waste-to-energy sector is picking up political, legislative and capital concessions and opportunities. These drivers, in turn, lead to a more aggressive growth profile for the renewable energy/cleantech sub-sector, which should increase investors.

In South Africa, Kibo Energy (KIBO.L), a power generator, this year announced a strategy change – it signalled that it will become a renewable integrated energy production company using WTE. Kibo recently announced its first JV targeting production of 50 MW of WTE renewable energy to sell to industrial customers.

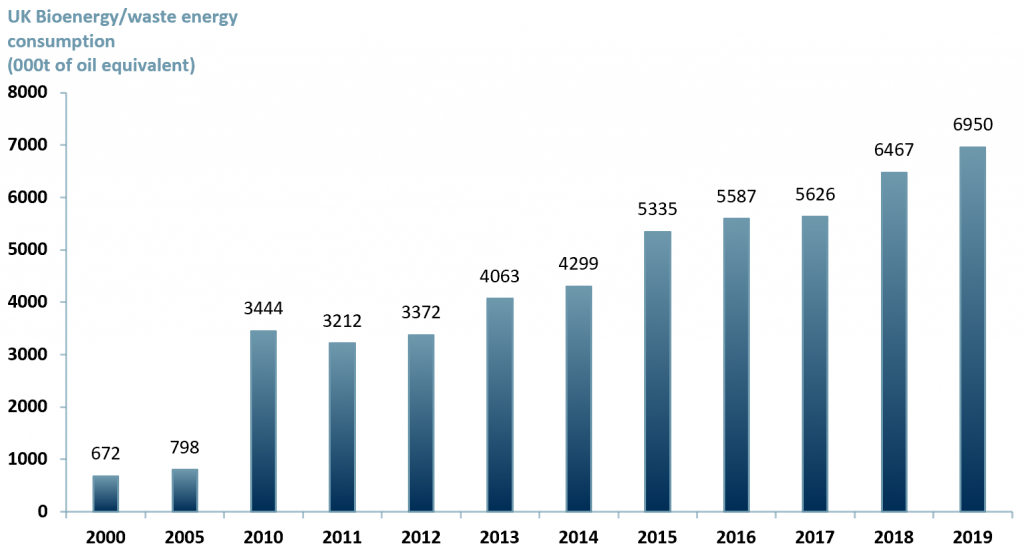

In the UK, the consumption of bioenergy/waste energy has increased to 6.1m metric tons over the last 20 years, as shown in Exhibit 1, figures climbed from 865k metric tons in 1998 to 6.950m metric tons in 2019.

Exhibit 1 – Consumption of bioenergy and waste energy in the UK (2000 – 2019)

Sources: ACF Equity Research Graphics; UK Department for Business, Energy and Industrial Strategy.

Sources: ACF Equity Research Graphics; UK Department for Business, Energy and Industrial Strategy.

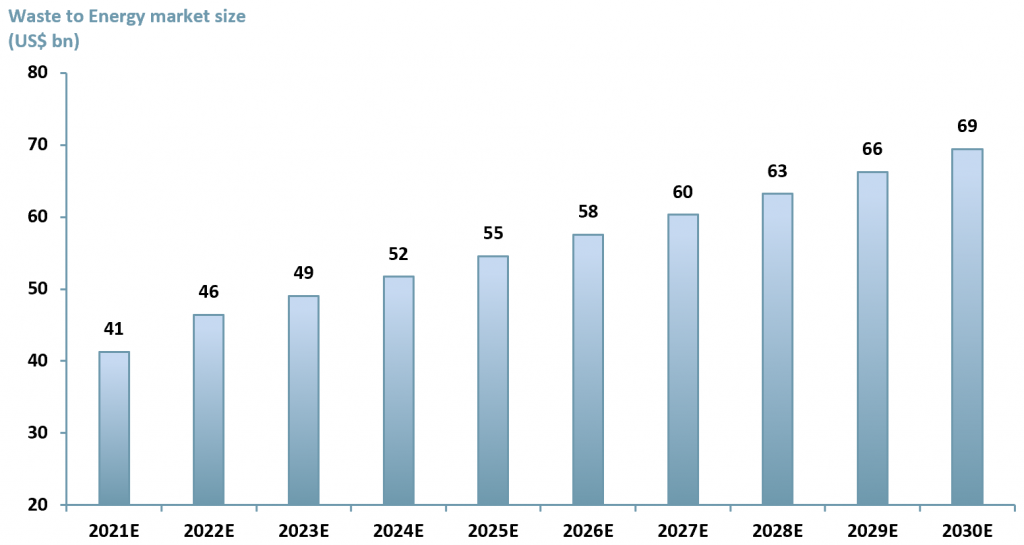

In Exhibit 2 below, we forecast the growth trend in the waste to energy sector will apply worldwide with an overall CAGR at 6.6% projected to 2030E.

We have modelled initial global GDP growth of 7% for 2021 and 2022 and 2.5% thereinafter.

For 2021E to 2023E our total CAGR is 12% reflecting our GDP forecast of 7% globally and the effects of the political and popular will to improve the environment as a result of the Covid experience.

For 2024E to 2026E our CAGR is 5.5%. After the initial jump in investment and political will plus the Covid GDP bounce back factor, in phase 2, we are forecasting CAGR 5.5% due to government incentives for companies that lead the way towards, or align themselves with, global emissions reduction targets.

For 2027E to 2030E our CAGR is 4.8% for the period, still above the global long run average for GDP growth of around 2.5%, but the market is likely to begin to mature and competition to play its role.

Exhibit 2 – Global waste to energy market size worldwide (2020E – 2030E)

Sources: ACF Equity Research Estimates; Grand View Research; Allied Market Research; Market Research Future.

Sources: ACF Equity Research Estimates; Grand View Research; Allied Market Research; Market Research Future.

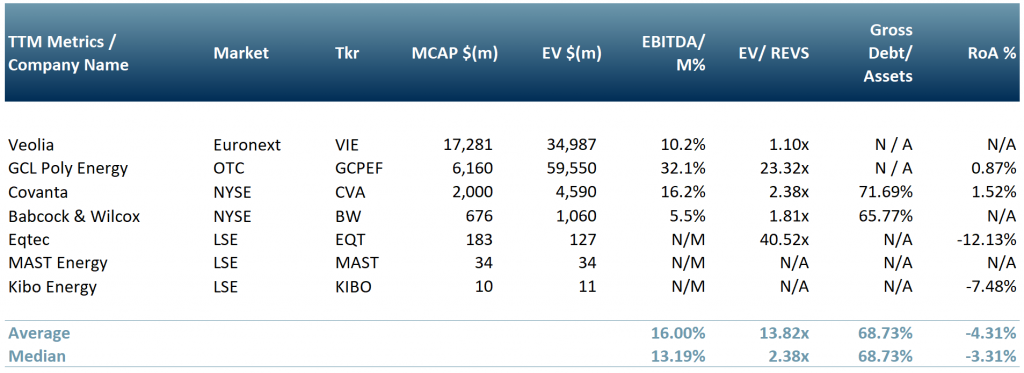

The trend towards renewables is undeniably global, it is not just hyper-developed nations that are incentivising or encouraging the transition to renewables. Companies such as South Africa’s Kibo listed in the UK (and its UK listed venture $MAST.L, in which Kibo has a 55% controlling stake), Veolia (VIE: Euronext), Covanta (NYSE: CVA), China’s GCL Poly Energy (OTC: GCPEF), Babcock & Wilcox (NYSE: BW) and Eqtec (EQT: AIM) have all entered the renewable market via WTE, their commitment and investment helps underpin our WTE market growth forecasts.

Exhibit 3 shows a Peer group analysis of the WTE companies referenced above.

Exhibit 3 – Peer group table of five listed companies in the waste to energy sector.

Exchange rates: (Source: XE.com) GBP vs USD 1.4077; EUR vs USD 1.21694; CNY vs USD 0.155614; Source: ACF Equity Research; Yahoo Finance.

Exchange rates: (Source: XE.com) GBP vs USD 1.4077; EUR vs USD 1.21694; CNY vs USD 0.155614; Source: ACF Equity Research; Yahoo Finance.

There are significant ESG and EVA benefits generated by WTE:

Waste-to-energy facilities are valuable resources to help protect the environment and, reducing waste (up to 90% for our Wollert example) and cut greenhouse gas emissions.

Transporting food waste to landfills can be costly (Logistics, long distance, oil) and have a negative impact on the environment. (Pollution).

In addition, Waste to energy facilities help companies to find alternative ways to be profitable by reselling excess energy to a national grid.

This sector is developing fast and is looking like a stronger and stronger growth opportunity ($KIBO.L, $MAST.L). Yarra Valley is a great example (with its positive results and the opening of Lilydale soon) of how efficient these companies are and the positive impacts – environmental and financial – these WTE facilities have.

Waste to energy facilities present investment opportunities and work closely with communities, which is ESG positive and EVA enhancing when done well. WTE contributes economically and environmentally by reusing (recycling) our food waste, cutting emissions per kWh and reducing landfill pollution.

WTE is increasingly important as governments and the general investing public think more forcefully about the polluter pays problem.

There is, in our view, an imminent re-rating coming for companies that can deliver and demonstrate the ESG and margin benefits of WTE.

Author: Anne Castagnede – Anne leads the Sales & Strategy Team at ACF Equity Research. See Anne’s profile here