Virtual high street is set to surge

E-commerce platform providers are poised to see exponential growth owing largely to the surge in consumers online purchasing activities.

Key Points:

- Traffic at US bricks and mortar stores on Black Friday (27 Nov 2020) fell by 49% compared to last year, according to data from Sensormatic Solutions (a privately held company, providing analytical solutions to firms in the retail sector).

- Traffic for the six key weeks of the holiday season in 2020 in retail stores slowed down by 33.1% , yoy. (Sensormatic Solutions)

- Black Friday online spending reached US$ 9bn, up nearly 22% yoy according to data from Adobe Analytics (parent company, ADBE: NasdaqGS).

- Cyber Monday (30 Nov) sales reached a record US$ 10.8bn, representing a 15.1% growth from 2019.

Inevitably Black Friday data in 2020 is additionally complicated by two factors:

1) the demand side driver to avoid covid-19 infections and the dampening effect of lower economic consumer confidence and;

2) the supply side dampening effect of less choice due to reduced inventory (direct Coronavirus effects) and less business certainty over the immediate economic future.

The overall effect of the pandemics, outside of Black Friday effects, has driven e-commerce sales aggressively upwards – increasing its share of total retail sales. In turn, online platform businesses have benefited from this trend.

E-commerce companies like Amazon (NasdaqGS:AMZN), Shopify (NYSE:SHOP), eBay (NasdaqGS:EBAY) and Etsy (Nasdaq:ETSY) have all experienced what amounts to upward re-ratings in their equity valuations.

Following the tech re-ratings, and in the nature of markets, portfolio manager asset allocation has shifted out of technology and e-commerce and back into value stocks, after optimism for value stocks picked up following C-19 vaccine releases. This value stock optimism may well be misplaced or at least too early (which amounts to the same thing).

In early November 2020, Pfizer (NYSE:PFE) in collaboration with BioNTech (NasdaqGS:BNTX) and Moderna (NasdaqGS:MRNA), announced the production of a vaccine with 90% – 95% efficacy, others followed in Pfizer’s and BioNTech’s wake.

Market sentiment reflects the idea that once a vaccine becomes available, online retail demand will decline sharply as brick-and-mortar shops resume normal operations. We do not wholly agree.

On the back of this we have seen a moderate relative downswing in the valuations of technology and e-commerce platform stocks. However, we believe there is still a strong investment case for the e-commerce industry, both in terms of timing and further upward re-ratings.

ACF E-commerce Drivers:

Growth in the e-commerce market was already well supported prior to Covid and C-19 has only accelerated what was evitable.

UK retailer Arcadia (that owns brands such as Topshop and Burton) went into administration. Debenhams, UK national department store chain, announced it will close its doors permanently. There are many other losses of this type.

We expect the pandemic effects for acutely affected sectors to last a further 12 months. The question is how many traditional stores will remain in business post-Covid?

In our view, the Covid driven increase in online shopping will continue long after Covid is past and will never reverse fully. While quick and easy home delivery is the driving factor, there is also an element whereby online shopping is overall less risky from a range of health perspectives.

Those bricks and mortar stores that survive will have to adapt to this ever more aggressive growth in the transition to online shopping.

There will be fewer stores located in key areas (a self-reinforcing downward spiral as fewer stores means there is less reason to go out and shop).

Stores and store chains that survive will have a much better online presence – this means sharing more margin with platforms like Amazon (NasdaqGS:AMZN).

There is also a negative read-through for landlords specialising in A-grade retail commercial property rental. This pressure on landlords in retail commercial property is likely to propel a wave of change of use applications – that creates a structural change that reduces the availability of bricks and mortar store sites.

In turn, a reduction in retail store site opportunities could keep rents up reducing competitiveness further of a bricks and mortar retail strategy.

The rise in digital dependence, in particular the social media influence, will continue to drive up online sales. Many companies now use social media influencers as part of their advertising campaigns.

ACF Forecast:

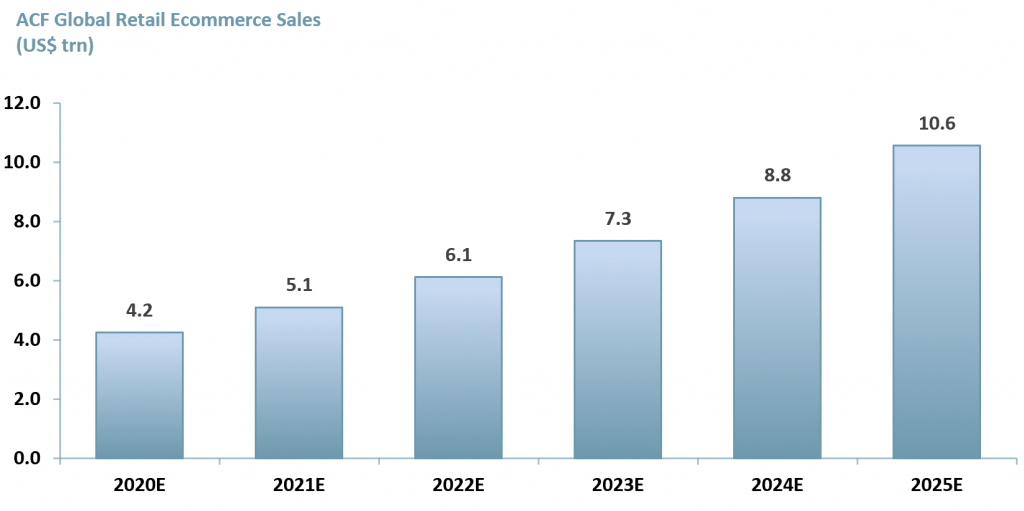

Given our views, we forecast that the global retail e-commerce sales will increase to US$ 10.6trn by 2025E, a 5-yr CAGR of 20%, up from $3.5trn in 2019. (see Exhibit 1)

Exhibit 1 – Global Retail Ecommerce Sales 2020E – 2025E

Source: ACF Equity Research Forecasts.

Source: ACF Equity Research Forecasts.

E-commerce platform providers will continue to leverage their technology in order to benefit from our increased demand forecast. Advertising and marketing will continue to move online, in line with the move of eyeballs.

This will benefit the large social media companies such as Facebook (Nasdaq:FB) and Twitter (NYSE:TWTR) who rely on advertising for a much of their revenues.

The future looks bright for technology companies, even after Covid-19 fades from the immediate investment agenda.

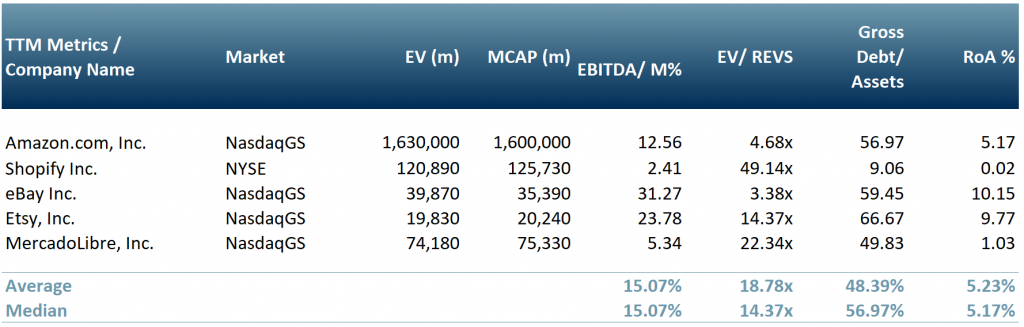

In exhibit 2, we show ACF’s peer group of ecommerce platform providers – Amazon (NasdaqGS:AMZN), Shopify (NYSE:SHOP), eBay (NasdaqGS:EBAY), Etsy (Nasdaq:ETSY) and MercadoLibre, Inc. (NasdaqGS:MELI). As the platforms become more dominant for retail consumption so their purchasing power increases – expect their EBITDA margins to rise.

Exhibit 2 – Ecommerce Platform Providers

Source: ACF Equity Research Graphics

Source: ACF Equity Research Graphics

Author: Adeline Bockarie – Adeline is a Junior Staff Analyst at ACF Equity Research. See Adeline’s profile here