Antimony and the US ammunition shortage

The possibility of a ‘critical minerals ’ shortage is approaching and has been on the global radar since the middle of 2021. The International Energy Agency (IEA) has warned mining companies that the “looming mismatch” between supply and demand needs to be addressed.

However, the urgency is not necessarily fuelled by a concern of supply chain disruptions but rather the role critical minerals play in the transition to clean energy. If we are to reach the Paris Agreement goals by 2050, critical mineral production will need ramping up.

Critical minerals such as antimony, lithium, copper, cobalt, nickel and rare earth metals are used in renewable energy infrastructure (i.e., solar panels), batteries and power cables. But is this the only reason that we are seeing an increase in demand and therefore an increase in prices of critical metals?

In this blog we focus on antimony because of its scarcity, which in turn implies a supply risk, and its significance to the US ammunition shortage of 2020-21.

Why Antimony

Antimony comes from the Greek anti and monos, meaning a ‘metal not found alone’ and industrial use dates back to as early as the 17th century, other uses may go back as far as 1600 BC. In spite of the implications of its name, Antimony can be found as a native metal.

Antimony (Sb) has semi-metallic properties. Because it is a poor heat and electricity conductor it is often alloyed with other metals to change its or their properties, making it more durable and versatile. Antimony is most often alloyed with lead (Pb) and tin (Sn), making the elements more rigid or stiff – ergo cast bullets.

In addition to being an important mineral for ammunition and other defence needs, antimony is in high demand because of its use in clean energy infrastructure.

Renewable energy – Solar panels, wind turbines, generators, batteries, and nuclear reactors.

Technology – Smartphones, computers, semi-conductors, and automotives.

Defence – Ammunition, tanks, submarines, warships, communication systems, night vision goggles, infrared sensors, and other military technology.

In the US there is an ongoing ammunition shortage. This has been driven by the pandemic triggered supply shortages combined with demand increases underpinned by civil unrest throughout 2020 – stimulating an increase in gun sales.

According to Small Arms Analytics (a South Carolina, US consulting firm) 23m guns were purchased in 2020, up ~65% vs. the 13.9m sold in 2019. In March 2021, the FBI conducted ~4.7m background checks vs. 3.7m y/y for gun sales.

Increased gun sales coupled with global lockdowns and the US’s reliance on antimony imports from China, has created an ammunition shortage. China produces around 75% of global antimony supply, followed by Russia as the second largest global producer.

Price drivers of antimony

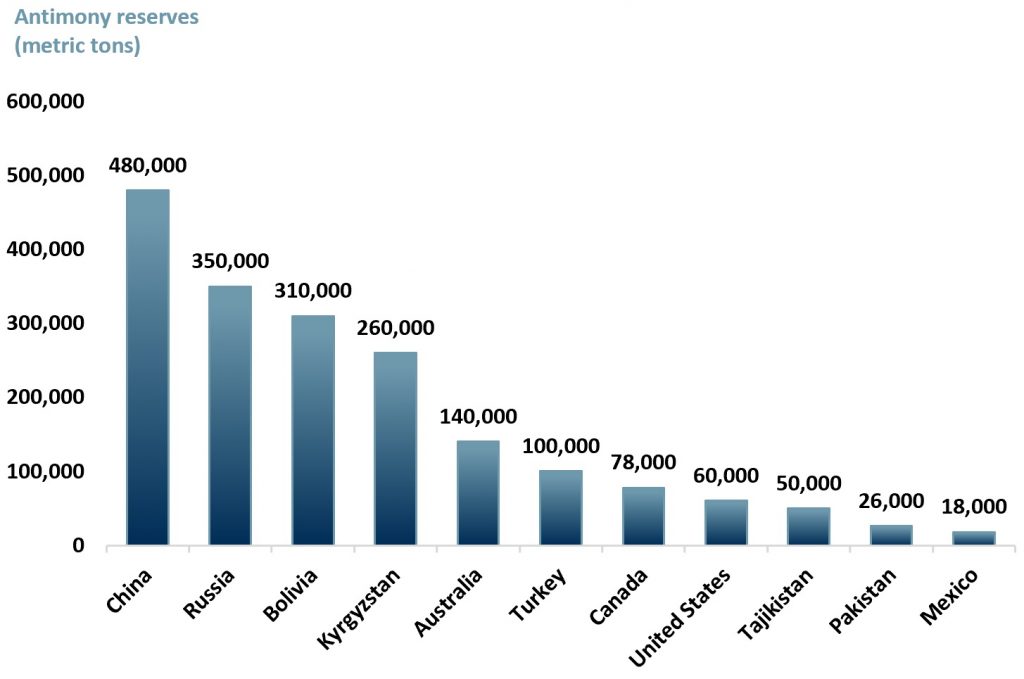

China is the largest producer of Antimony and had ~480,000 metric tons of reserves in 2020A, according to the USGS (exhibit 1). In 2020A, China produced 80k metric tons (MT) of global output, followed by Russia at 30k MT and Tajikstan at 28k.

Exhibit 1 – Global antimony reserves by country, 2020A

Sources: ACF Equity Research; US Geological Survey

Sources: ACF Equity Research; US Geological Survey

After the Sunshine Silver Mine in Idaho closed in 2001, there has been no marketable antimony mined in the US – the US is entirely reliant on imports from China. Global lockdown restrictions caused mines to close creating a supply chain disruption.

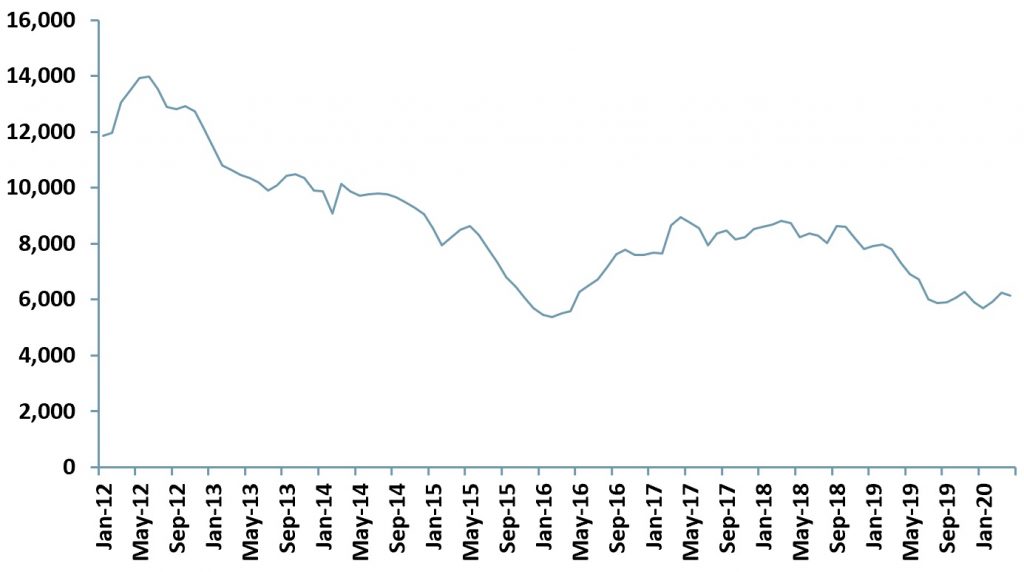

Antimony is priced in USD based on the London Metal Exchange (LME) average price C.I.F. Rotterdam per metric ton (Mt) (exhibit 2).

Exhibit 2 – Price of antimony (US$/MT) -2020A

Sources: ACF Equity Research; US Antimony

Sources: ACF Equity Research; US Antimony

Antimony prices jumped in Sep 2021 to a 12 month high following water contamination concerns whilst China kept mines closed. The price of antimony rose to $12,700-13,150/MT on 22 Sep vs. $12,500-13,100 in the previous week (Metal Bulletin, Sep 2021).

China’s dominance of the market is also spearheaded by the country’s continuous purchasing of antimony deposits in order to increase its supply potential and to pose challenges to the viability competing operations.

The US ammunition shortage, China’s neo-monopolistic strategy and supply chain failings have kept the price of antimony above $6,000/MT (C.I.F. Rotterdam price).

Is this a short-term or long-term structural increase in the price of antimony?

The US’s second amendment of the Constitution is the ‘right to bear arms’. A 2017 study by the Geneva-based Small Arms Survey recorded that Americans owned 46% of the global stock of firearms – there were enough firearms for every man, woman and child to own one each with 67m left over.

To put the situation in a yet clearer perspective, for every 100 residents in 2017, in the US there were 120.5 civilian-owned firearms. Yemen came second with 52.8. firearms per 100 civilians (Small Arms Survey, 2018).

The data and analytics, suggest an increasing structural increase in the price of antimony. Like all commodities, antimony has also entered a commodity super cycle. The global economy continues to face pandemic triggered supply disruptions, and there seems little doubt now that Russia’s war with Ukraine and subsequent sanctions will serve to push and support antimony prices at yet higher levels.

Once war and sanctions subside, we believe that antimony prices will remain on a higher footing because of the ‘shock of war’ in Europe combined with a vague alliance between Russia and China reminding markets that almost the entire supply of global antimony is controlled by two countries. One of those countries has demonstrated that it is not economically rational, at least in the short and mid-terms and as such could switch off supply at any time.

Other economic effects of Russia’s behaviour are likely to be the creation of global stock piles, an activity that will also support yet higher prices in the short to mid-term.

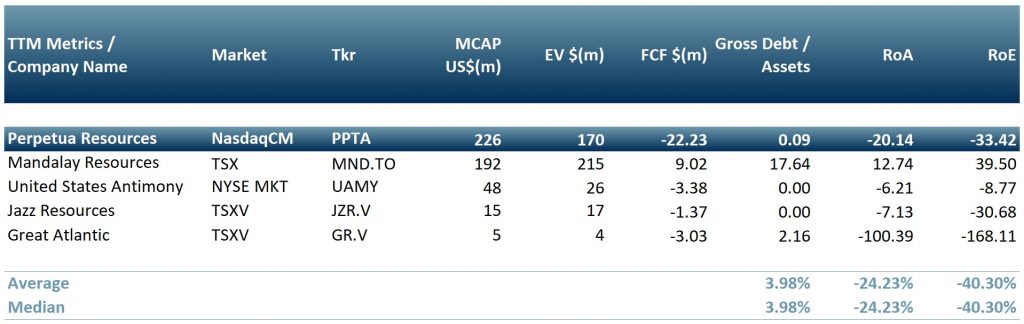

In exhibit 3 we show a peer group of five publicly tradeable antimony stocks: Perpetua Resources (NASDAQ:PPTA), Mandalay resources (TSX:MND.TO), United State Antimony (NYSE:UAMY), Jazz Resources (TSXV:JZR.V) and Great Atlantic Resources (TSXV:GR.V).

Exhibit 3 – Peer group of antimony miners

Sources: ACF Equity Research Graphics; Refinitiv.Exchange rate: (Source: XE.com) CAD vs USD: 0.7882

Sources: ACF Equity Research Graphics; Refinitiv.Exchange rate: (Source: XE.com) CAD vs USD: 0.7882