Steel demand likely to outstrip supply by 2024

The Climate Action 100+ coalition (CA100+) says that the steel industry is not expected to meet targets of cutting CO2 emissions by 91% by 2050E. Out of the 107 global steel companies producing a combined 3m tonnes in 2020, only nine have committed to achieving net zero targets.

Among the nine are China Baowu, ArcelorMittal (NYSE: $MT), Nippon Steel (Tokyo: $5401.T), China’s HBIS, Posco (KSE: $005490.KS), US Steel (Sao Paulo: $USSX34.SA), Thyssenkrupp ($TKA.DE: XETRA), SSAB ($SSAB-B.ST: Stockholm) and Outokumpu ($OUT1V.HE: Helsinki).

- Institutional Investors Group on Climate Change (IIGCC) is putting pressure on the steel industry to meet net zero emissions targets. IIGCC is an influential institutional investor group with $55trn assets under management, that created the CA100+.

- CA100+ is an initiative led by investors that focuses on supporting and ensuring that the global large-cap greenhouse gas (GHG) emitters, which includes 167 companies, are taking necessary action to fight climate change.

- The top 10 steel producers accounted for 27% of global GHG emissions in 2020 with the top three ArcelorMittal, China Baowu and HBIS making up 13% combined – all three of which have committed to the CA100+ net emissions targets.

- CEO of IIGCC Stephanie Pfeifer suggests that steel companies will need additional funding, government support and tech advances if they are to achieve net zero targets e.g., ArcelorMittal estimated that its costs for meeting net zero targets for its European operations could reach $65bn.

- CA100+ estimates that the total capital spending needed for the entire steel industry to reach net zero is ~$1.3trn.

Steel production

Steel is the most commonly used metal globally given its high tensile strength and low cost. Steel’s versatility allows for its variable uses in building & infrastructure (52%), mechanical equipment (16%), automotives (12%) and ‘other’ (20%). ‘Other’ includes electrical equipment and domestic appliances (Worldsteel, 2021).

In its raw form, steel is known as crude steel – the first solid state after melting. Crude steel is what is produced globally and then sold for processing.

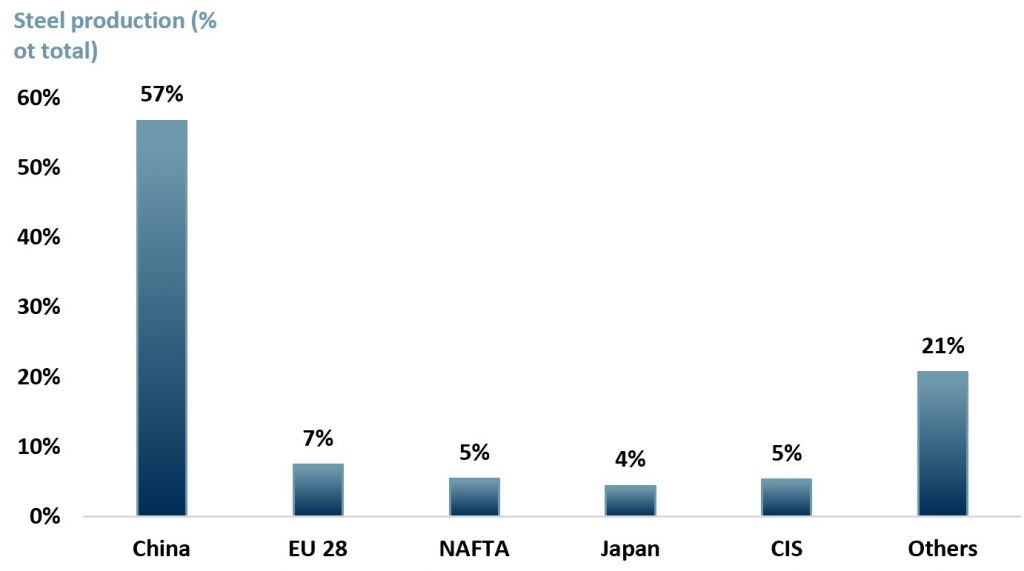

China is the world’s largest producers of crude steel, delivering 1,053m metric tonnes (Mt) in 2020 and making up ~56% of total global production followed by India at 99.6m Mt or 5% in 2020. See exhibit 1 below for dominant geographical groupings. In 2020A there were 1,864 Mt of steel produced globally.

Exhibit 1 – Global crude steel production by countries and regions 2020A

Sources: ACF Equity Research, WorldSteel. NAFTA = US, Canada, Mexico. CIS = Azerbaijan, Armenia, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Uzbekistan, Ukraine

Sources: ACF Equity Research, WorldSteel. NAFTA = US, Canada, Mexico. CIS = Azerbaijan, Armenia, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Uzbekistan, Ukraine

The price of crude steel peaked in May 2021 at ~CNY 5,960/t (~US$ 922.33/t) up from an all-time low in October 2016 at ~CNY 2,180/t (~US$ 337.43/t) (Trading Economics, 2021).

As with all commodities, the price of steel has risen as a result of supply chain and production disruptions the industry faced because of the pandemic. In addition, efforts to decarbonise the industry are also contributing to this price increase as there is a growing demand for ‘greener’ steel, which is more expensive to produce.

The steel market

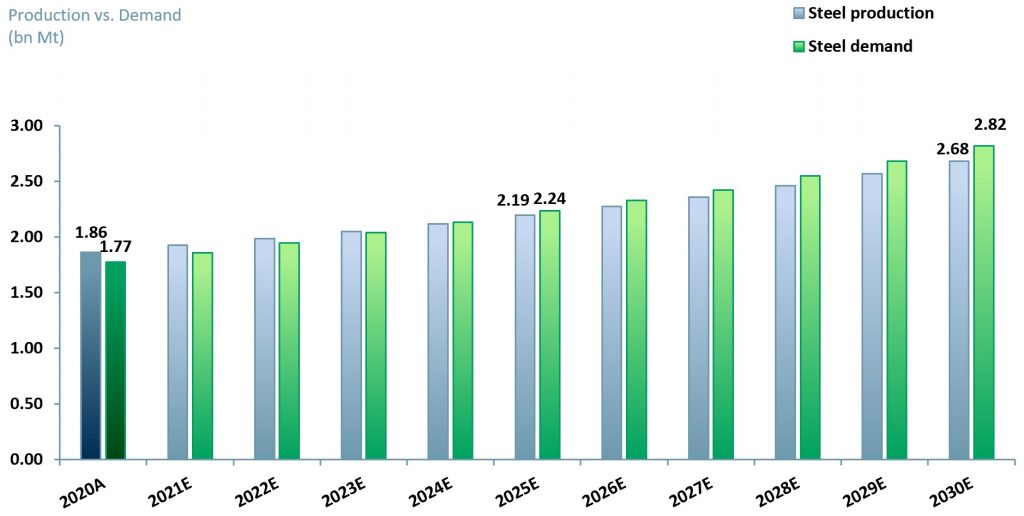

ACF forecasts a steady growth of production and demand for steel until 2030E. Demand is projected to surpass production at 2.82bn Mt at a CAGR of 4.93% with production at 2.68bn Mt at a CAGR of 3.75% (exhibit 2).

Exhibit 2 – Global steel production vs. demand forecast 2020A-2030E

Sources: ACF Equity Research; Worldwide; DBS Group Research; World Steel Association

Sources: ACF Equity Research; Worldwide; DBS Group Research; World Steel Association

ACF’s forecast is less conservative than the market consensus for the following reasons:

- The economic uncertainty driven by the pandemic will continue in the short-term and it will impact steel extraction and production.

- Steel demand will continue to rise as it is the most commonly used metal globally. Demand is driven by construction and automotives.

- The decarbonisation of the industry will, during a transition period, reduce steel supply and at the same time the increase in demand for electric vehicles will boost steel demand.

Therefore, our insight is that steel production will struggle to keep up with steel demand for a protracted transition period, unless the steel industry accelerates the rate of its green energy transition.

While the steel industry’s carbon footprint remains a cause of global concern for investors, there is hope and there is change. Several companies have adopted DRI production as an alternative to carbon intensive steel production processes.

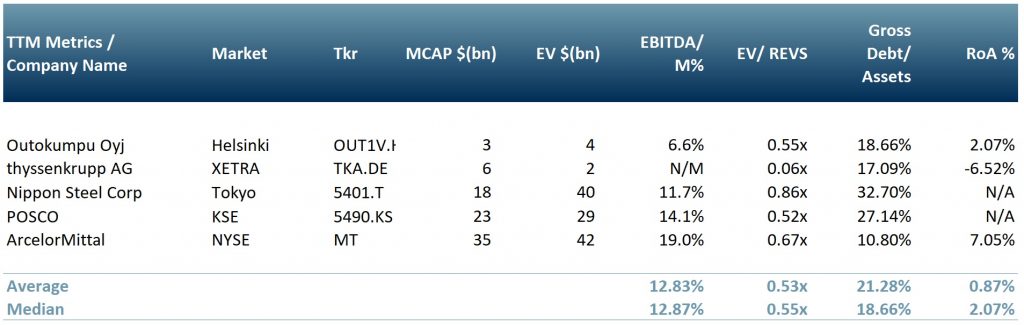

Global initiatives such as the CA100+ will continue to put pressure on the industry, forcing an expedited shift to green or greener technologies in the production process. In exhibit 3 we have selected a peer group of steel producers that are transitioning towards green steel production.

Exhibit 3 – Peer group of the top steel producers worldwide

Sources: ACF Equity Research, Exchange Rate: (Sources: XE.com), JPY vs. USD: 0.0091; EUR vs. USD: 1.1761; KRW vs. USD: 0.0009

Sources: ACF Equity Research, Exchange Rate: (Sources: XE.com), JPY vs. USD: 0.0091; EUR vs. USD: 1.1761; KRW vs. USD: 0.0009

Authors: Anda Onu and Renas Sidahmed – Anda is part of ACF’s Sales & Strategy team, Renas is part of ACF’s Sales & Strategy team and a Staff Analyst. See their profiles here