How sustainable is Nickel usage

LME is putting some teeth into its Responsible Sourcing Requirements. A Joint Due Diligence Standard was approved by the London Metals Exchange (LME) in mid Dec21. Listing copper (Cu), lead (Pb), nickel (Ni), and zinc (Zn) producers.

Recent changes to the responsible sourcing regulatory landscape

A responsible sourcing requirement Joint Standard was launched on 1 January 2021 by five organizations: Copper Mark, the International Lead Association (ILA), the International Zinc Association (IZA), the Nickel Institute and the Responsible Minerals Initiative (RMI). The Joint Standard focuses on the supply chain risks of Cu, Pb, Ni and Zi while supporting effective due diligence for producers. The standard aims to include materials required for the production of metal products and not ‘principal covered metals’ at mining sites.

LME’s Responsible Sourcing Requirements applies to all existing and future LME brands (producers). The requirements are as follows:

- Implement OECD ‘s Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (OECD Guidance). Reporting is required to start from 30 Jun 2022, with full compliance by 31 Dec 2023.

- Maintain ISO 14001 (Environmental Management) and ISO 45001/OHSAS 18001 (Occupational Health and Safety) international standard certificates.

- The Joint Standard assessments is also used to meet customer, investor, and other stakeholder needs for due diligence in minerals supply chains. These will become a public indication on responsible sourcing standards for the assessed brands. (Nickel Institute, 2021)

- RMI released its “Global Responsible Sourcing Due Diligence Standard for Mineral Supply Chains — All Minerals”, with assessments to start during 2022 under its flagship program Responsible Minerals Assurance Process (RMAP). The RMAP’s assessment of responsible mineral procurement is third-party verified. (RMI, 2021)

The price of nickel post-pandemic

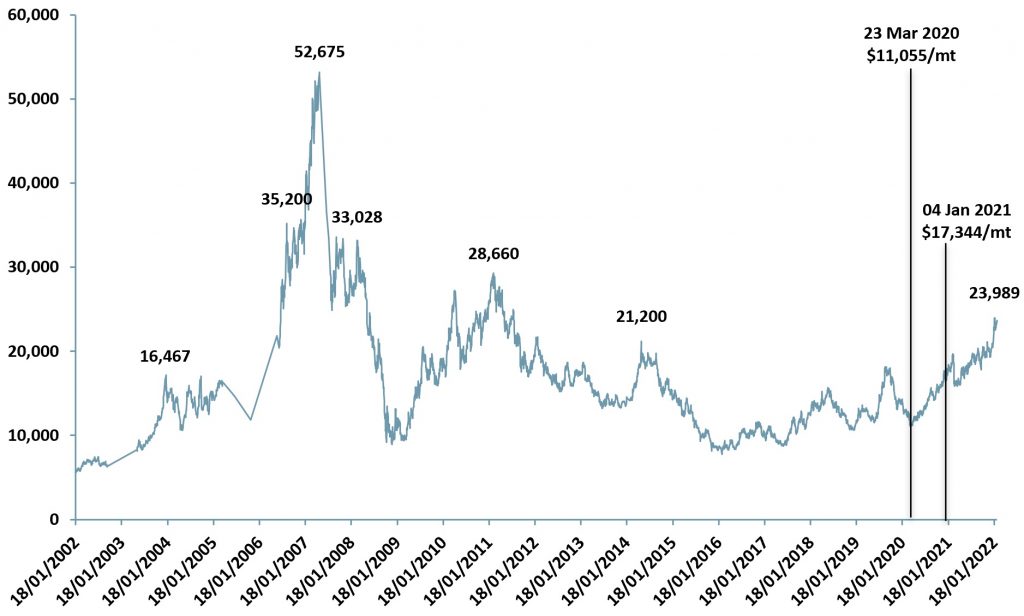

Nickel demand was initially hit by the Covid-19 pandemic, as were all commodities, reaching a low of $11,055/MT on 23 March 2020 (exhibit 1).

However, as the pandemic placed a spotlight on climate change (i.e., the less motor vehicles on the road due to lockdown restrictions meant clearer skies and cleaner air in cities) and demand for electric vehicles (EVs) grew, nickel prices began to rebound.

At the start of 2021, prices for nickel kicked off the year at $17,344/MT – a 57% increase. By 21 Jan 2022, prices had reached $23,989/MT (the highest since July 2011).

Supply constraints – a changing landscape for Nickel

As demand for nickel increases in the EV/renewable space and supply chain disruptions continue, the supply deficit is set to continue. Russia’s war with Ukraine will do little to alleviate upwards price pressure.

The nickel industry has been hit by Covid supply disruptions and suffers from seasonality – the largest producing country, Indonesia, experiences heavy rainfall between October and April, which disrupts production during those months. With climate change it is reasonable to suppose that production disruption will be extended and deepened.

Indonesia has also hinted that it will impose levies, via an export tax on nickel products containing less than 70% nickel.

Indonesia’s signalling on nickel exports, whether or not it leads to a tax levy, serves to drive nickel prices up as exporters attempt to compensate for potential tax increases ahead of their arrival.

Exhibit 1 – Nickel spot price (US$/metric tons)

Sources: ACF Equity Research Graphics; Business Insider

Sources: ACF Equity Research Graphics; Business Insider

Demand drivers only growing for Nickel

Nickel’s natural alloy properties have been utilised since 3500 BC; it delivers corrosion resistance at high temperatures.

Nowadays, nickel alloy is extremely valuable for the steel industry (used in stainless steel) and demand from the battery sector is increasing.

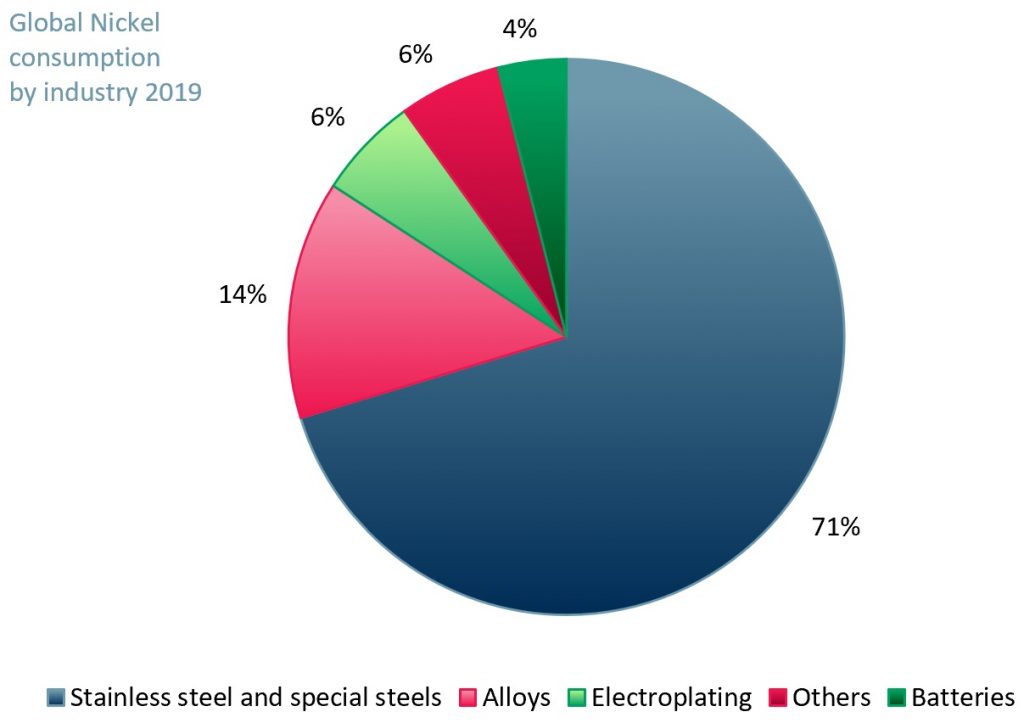

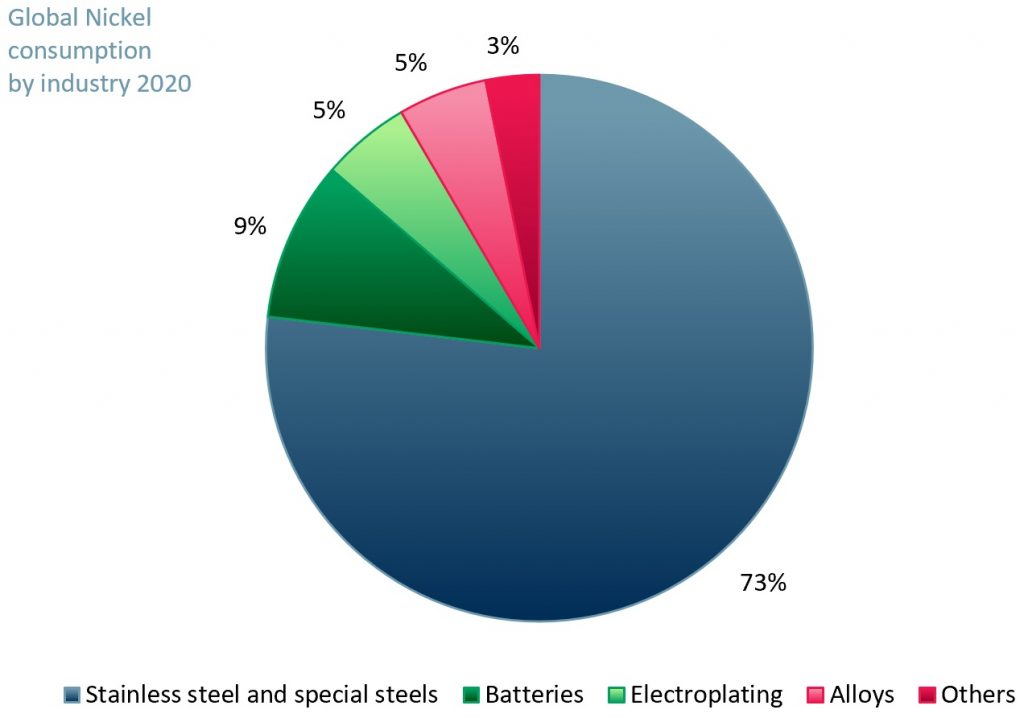

Consumption is still dominated by the steel industry (73% in A), and we anticipate demand from the steel industry will only grow as the global economy continues to industrialise and transitions to green energy production.

Nickel is among the most used, out of all the mined metals included in the Joint Standard assessments, in clean energy technologies today.

Ni can be found in most devices from laptops (they consume less energy than desktops), to EV car batteries and renewable energy equipment such as solar panels and wind turbines.

According to the IEA, nickel is considered a critical metal in the following clean energy technologies: geothermal, EVs and battery storage, and hydrogen (exhibit 1). Given its properties, high melting point etc., we see only more applications for, and consumption of, nickel in battery technologies and production. In 2020A, consumption of nickel for batteries increased to 9% vs. 4% in 2019A (exhibit 2).

Exhibit 2 – Distribution of primary nickel consumption worldwide by industry 2019A vs 2020A

|

|

Sources: ACF Equity Research Graphics; Focus Economics; Sources: ACF Equity Research Graphics; Nornickel

Nickel recycling – already at scale

At present, the quantities of nickel metal recovered through recycling varies depending on the device recycled.

For example, according to Argonne National Laboratory data, a single car lithium-ion battery pack (NMC532) contains ~35kg of nickel, 8kg of lithium, 20kg of manganese and 14kg of cobalt. (Nature, 2021)

Guangdong Brunp Recycling Technology — a Foshan-based subsidiary of China’s Contemporary Amperex Technology Company Ltd (CATL) — has capacity to recycle about 120k metric tons/year of batteries. That is the equivalent of 200k cars, which is the equivalent of ~ 7,000 metric tons/year of Ni that can be recycled. (Nature, 2021)

ACF forecasted that in 2030E there were 2.5m EV cars on the road. This is the equivalent of 87,500 Mt of Nickel ,which equates to approximately 3.5% of total global nickel supply in 2020A of 2.5m Mt. CATL’s nickel recycling business alone can produce around 8% of the 2020A nickel consumed in EV cars.

EV battery technologies and production are demanding more nickel

Demand for nickel is increasing in EV battery cathodes due to its high energy density, The NMC 8-1-1 battery (80% nickel, 10% manganese and 10% cobalt for example, has an energy density 25%-30% higher than that of a lithium iron phosphate (LFP) battery. (Nickel Institute, 2020)

High energy density EV batteries (>200kW/kg) are also needed in larger vehicles that require more powerful batteries than cars, such as electric mining trucks. Electric trucks are forecasted to reach 1,413,694 by 2030E, up from 69,597 units in 2021E, a CAGR of 39.7%. (Market and Markets, 2021)

forecasts that by 2030E there will be 31m EVs sold per annum, up from 2.5m in 2020E.

Anticorrosion demand for nickel alloys

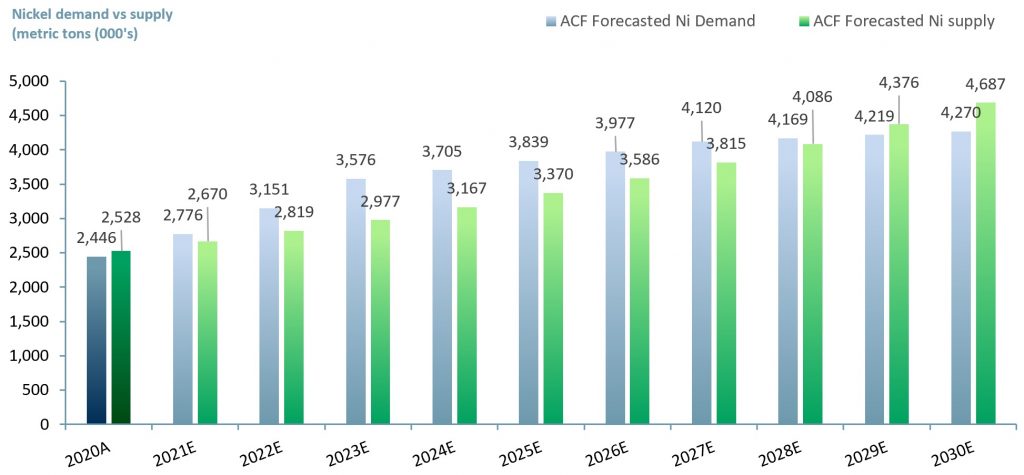

projects that in addition to steel demand growth, a ~35% surge in demand for EVs alongside renewable energy industry demand for nickel will help boost total global nickel consumption by 2030E to 4.3m Mt up from 3.15m Mt in 2022E, a CAGR of 5.7% (exhibit 3).

forecasts that the overall global supply of nickel will surpass demand in 2029E, reaching 4.7m Mt by 2030E, at a CAGR of 6.4% – due to the expected rise in nickel recycling and the emergence of new mining sites in Ni reach areas. In the intervening 6 years we expect nickel prices to rise strongly before softening in 2029/30.

Exhibit 3 – ACF Equity Research estimates on nickel demand and supply 2020A-2030E

Sources: ACF Equity Research Estimates; Norilsk Nickel; IEA; INSG

Sources: ACF Equity Research Estimates; Norilsk Nickel; IEA; INSG

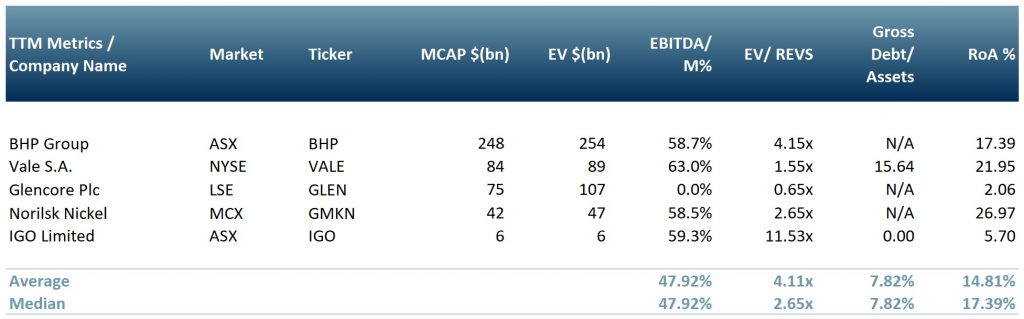

In the exhibit below, we show a peer group of the top five publicly traded nickel producers: BHP Group Ltd (ASX: $BHP), Vale (NYSE: $VALE), Glencore Plc (LSE: $GLEN), Norilsk Nickel (MCX: $GMKN) and IGO Ltd (ASX: $IGO) .

Exhibit 4 – Peer group of nickel mining companies

Sources: ACF Equity Research Graphics; Refinitiv. Notes: Refinitiv currency:GBP vs USD: 1.3499; RUB vs USD: 0.0130; BRL vs USD:0.1904; AUD vs USD: 0.7089

Sources: ACF Equity Research Graphics; Refinitiv. Notes: Refinitiv currency:GBP vs USD: 1.3499; RUB vs USD: 0.0130; BRL vs USD:0.1904; AUD vs USD: 0.7089

Authors: Anda Onu and Renas Sidahmed – Anda is part of ACF’s Sales & Strategy team, Renas is a Staff Analyst and part of the Sales & Strategy team. See their profiles here