Silver’s sustainable future

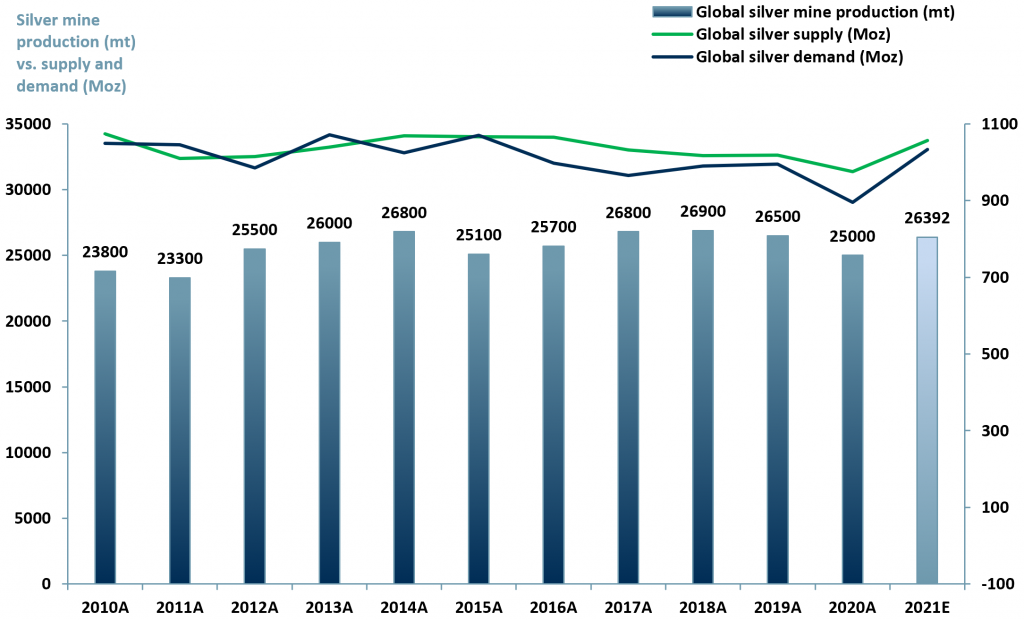

Towards the end of 2021, industrial demand for silver showed signs of softening. Notwithstanding the demand side, global mine production and supply of silver is forecasted to have reached and exceeded, respectively, pre-pandemic levels by YE21A.

However, we infer that the structural trend remains firmly in the direction of higher prices and a possible supply deficit.

Silver pricing development and fundamentals

This supply demand schedule suggests the price of silver will continue its 12m declining trend after its extraordinary March to September 2020 rally peak of £21.7 t/oz. Silver is currently trading around £17.6 t/oz.

Part of the decline in silver demand is associated with the Covid Omicron variant. Top consumer China reported, on average, lower Manufacturing Purchasing Manager’s Index (PMI) values vs. the global average manufacturing PMI.

- In December 2021 the global Manufacturing PMI was 54.2, China recorded 50.9. (Japan, another top consumer, reported a manufacturing PMI of 54.3 for the same period).

- Global silver mine production is forecasted at 26,392mt (metric tons) or 931Moz for 2021E vs. 25,000mt or 882Moz in 2020A and 26,500 or 935Moz in 2019A.

- Global supply is forecasted at 1,056Moz (million ounces) in 2021E vs. 976.2Moz in 2020A and 1,1018.7Moz in 2019A.

- Recycled silver 2021E is 196Moz (Silver Institute/Metals Focus), which accounts for the difference between supplied and mined and suggests around 6.7% more supply than demand, or alternatively a confidence interval of around 93% for the data collected and estimated. See supply and demand exhibit below.

Whilst demand growth resumes, the industry continues to face supply chain challenges due to the pandemic and volatile shipping costs.

By the end of 2021/beginning of 2022, shipping costs had fallen as exhibited by the decline in the Baltic Dry Index by 5.8% as of Wednesday 12 Jan 2022 (its lowest since 16 Mar 2021). Nevertheless, shipping costs remain 8-9x higher than pre-pandemic levels (Freightos).

In spite of the downward sliver price trend in 2021, silver prices have performed well over the last two decades or so. Since mid-2003, silver has exhibited an upward price trend. Between 2011 and 2021 silver booked two of its three highest price spikes since 1975, one of which (April 2011) was a record for the 45yr period, printing at US$ 46.06 t/oz vs. today’s £17 t/oz.

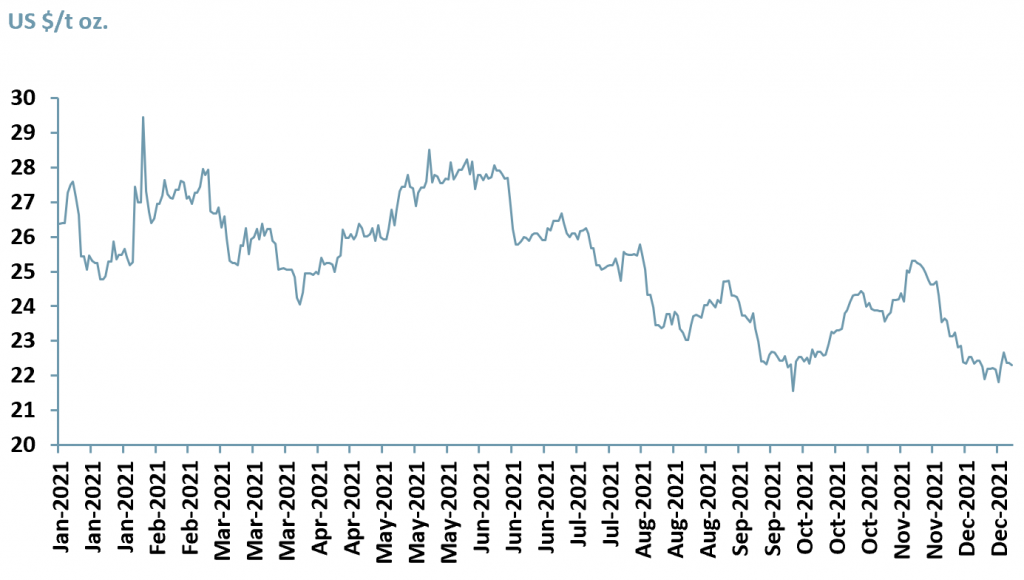

In the 12m 2021 chart (see exhibit 1) the sliver price shows a downward trend, that may well be correlated with demand and production changes driven by the Covid pandemic.

Exhibit 1 – Daily London fix price of silver Jan 2021A-Dec 2021A

Sources: ACF Equity Research, BullionVault

Sources: ACF Equity Research, BullionVault

Even though the 12m 2021 trend is downward pointing, the average silver price over the period was still sending bullish signals at $25/t oz., silver’s highest annual average price over the past 8 years (World Bank).

In our view the fundamentals remain strongly positive for the silver price – in the short run the global economy and increasing Omicron cases are an ongoing cause for concern with respect to demand and also, and perhaps equally, with respect to supply chain stability.

A sustainable future for silver?

Silver is found in its pure metallic state – unbonded with other elements (native silver), categorising it as a precious metal and therefore often used for currency, jewellery and silverware. However, due to its high electrical and thermal conductivity it has proven to be very useful in industrial applications (e.g., renewable energy infrastructure and automotives).

Silver is produced from the mining of native silver as a by-product of other metals (gold, copper, lead, zinc and uranium) and from the recycling of used materials (jewellery, photographic films and chemicals). The majority of silver (~80%) is produced as a by-product of other mineral mining or chemical processing.

The mining industry – including oil and gas – is perhaps the most scrutinised sector when the topic of sustainability arises. Data from the mining value chain, from extraction to shipping and finally to market, suggests strongly that mining makes a significant contribution to climate change and greenhouse gas (GHG) emissions, either directly or indirectly.

Sustainability drivers in the mining industry

Governments and investors are all expressing either the desire or need for high standards and expectations when it comes to the environment. Initiatives such as Climate-Smart mining and advancing technologies are creating opportunities for funding and driving innovations that will and are helping mining companies develop their sustainability processes and know-how.

According to the UN definition of sustainable development, precious metals (e.g., silver) are considered sustainable because they can be recycled and also because they can be used in an increasingly wide range of applications:

- Renewable energy equipment – silver is used in photovoltaic (PV) panel material, i.e., solar panels;

- Battery Electric Vehicles (BEV) and Plug-in Hybrid Electric Vehicles (PHEV) – silver is used in conductors and electrodes for charging batteries due to its resistance to corrosion and extreme conductivity;

- Clean water – silver ions are used to purify water systems and prevent water-born illnesses, e.g., Legionnaires’ disease;

- Medical applications and devices – silver nitrate/silver sulfadiazine/colloidal silver is added to wound dressings or creams because of silver’s recognised antimicrobial properties.

Our three favourite silver demand growth drivers – healthcare, renewables and electric vehicles

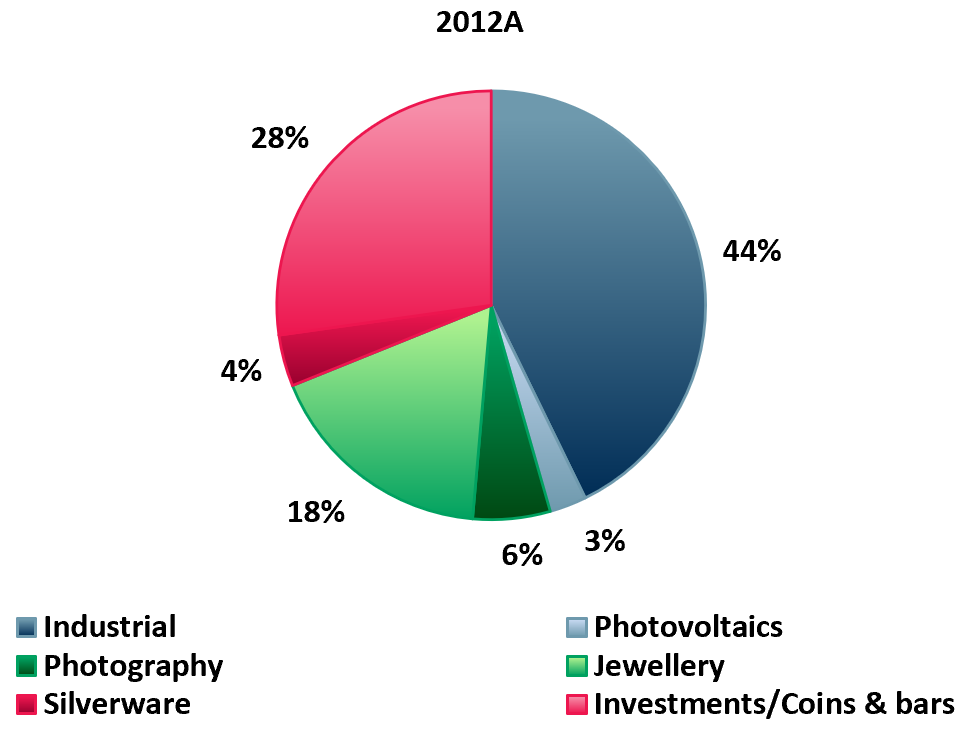

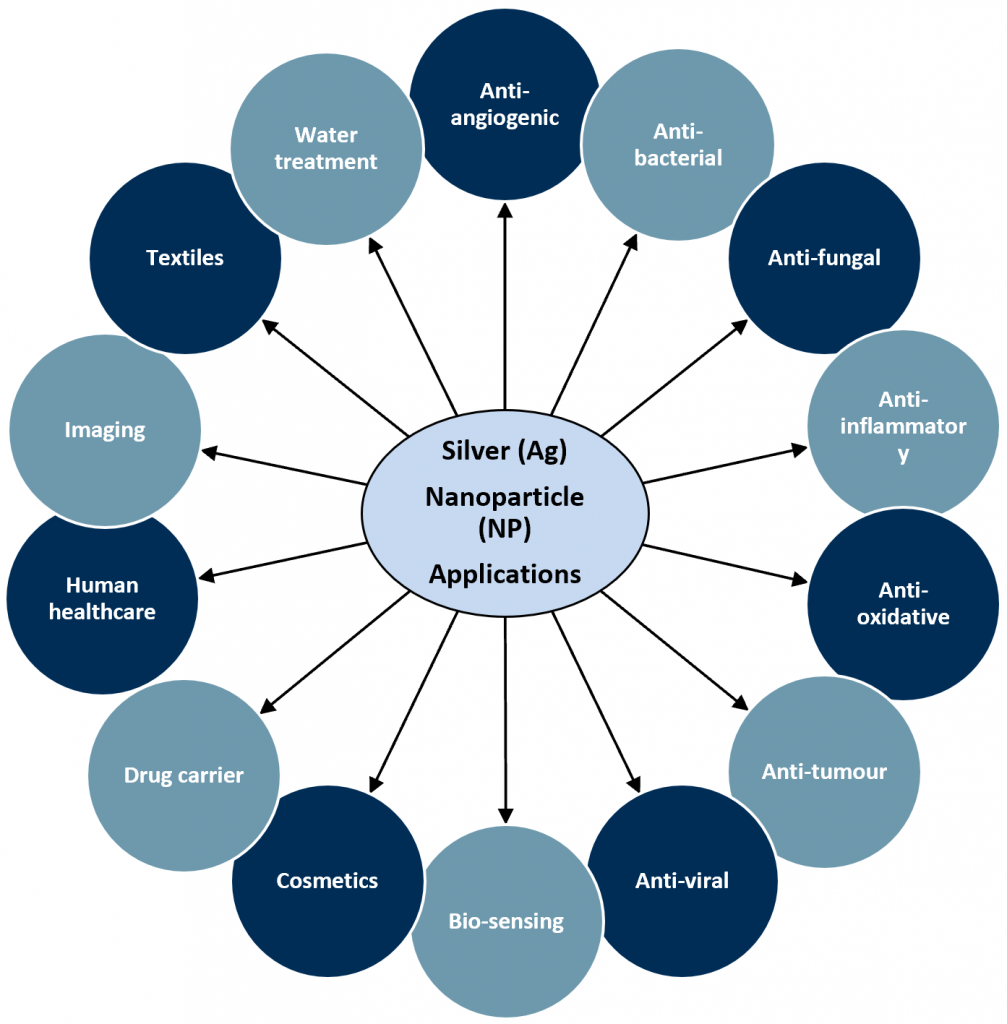

Data for 2020 shows that the demand for silver is dominated by the industrial sector. According to the Silver Institute Survey 2021 approximately 43% of silver went to industrial use vs. 44% in in 2012 (Silver Institute/World Silver Survey).

Exhibit 2 – Silver demand by end use 2012A & 2020A

|

|

Sources: ACF Equity Research, Silver Institute

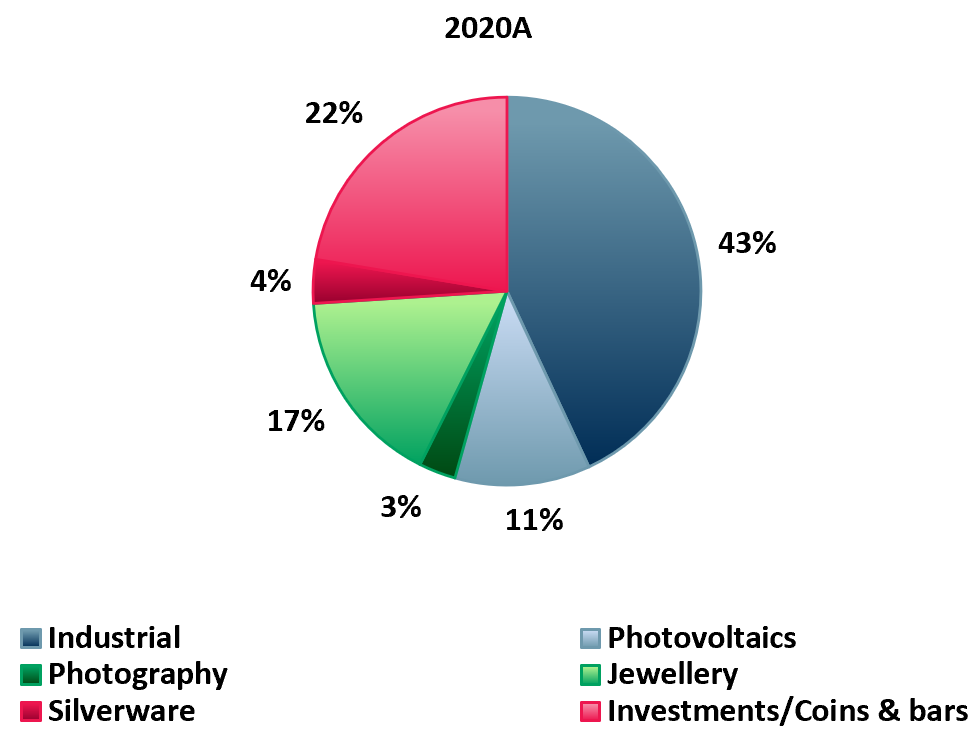

We expect demand fundamentals for silver to increase because of silver’s inert properties, its superior electrical conductivity and proven use as an antibacterial and as a coating for medical devices.

Healthcare

Healthcare uses are driven by the need for alternatives to antibiotics and the growth of the global middle class demanding greater and better healthcare services in China, India and other regions.

Exhibit 3 – Uses for silver in the healthcare market

Sources: ACF Equity Research

Sources: ACF Equity Research

Renewable energy

Silver’s inert properties and extraordinary electrical conductivity all point to it as an element that lends itself to increased inclusion in renewable energy, particularly photovoltaics, and suggests it will have an increasing role in a reusable and sustainable future.

Because of silver’s inert properties, we expect silver to attract increased industrial R&D spend/research. All other things being equal, increased R&D spend/research should lead to new and increased uses for silver.

Electric vehicles

Increased use in electric vehicles will continue to underpin industrial use and we expect production and purchases of EV vehicles to grow strongly out to 2040.

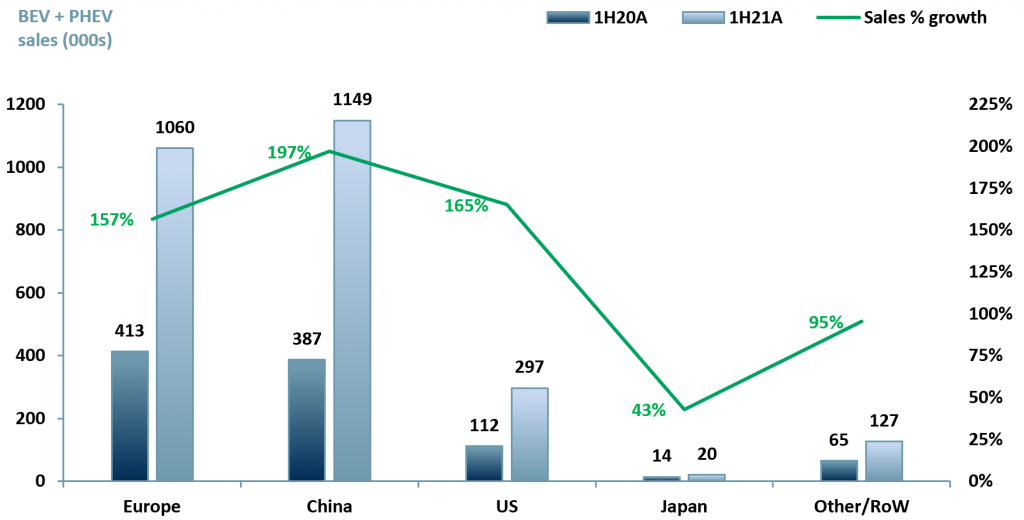

In 2020 there were a reported 3m EV car sales, up 40% vs. 2019. It is forecasted that by 2030E EVs will account for 60% of all new car sales vs. 4.6% in 2020A (IEA). We (ACF Equity Research) forecast EV car sales to reach 31m units p.a. by 2030E.

In 1H21A, EV sales printed record numbers globally y/y. In exhibit 4 we chart the number of sales and % growth for Battery Electric Vehicles (BEV) and Plug-in Hybrid Electric Vehicles (PHEV).

Exhibit 4 – BEV and PHEV sales and % growth 1H20A vs. 1H21A

Sources: ACF Equity Research; EV Volumes

Sources: ACF Equity Research; EV Volumes

The data is a clear indication of the rate at which the EV market is growing on a global scale. As the demand for silver continues to grow and climate change remains in focus, can the industry keep up with supply?

Electronics – We also expect demand growth driven by electronics – switches, superconductors and circuit boards.

Portable wealth – Silver demand as portable wealth is likely to increase in a world in which stability is trending downwards rather than upwards – there are many short run manifestations of instability but the overall driver in our view is changing climate conditions in various currently populous parts of the world.

Innovation – Our final element of the new demand equation relates to a renewed drive for innovation relating to silver. This demand element is itself a function of environmental and sustainability concerns driven by capital availability conditional upon ESG and sustainability outcomes.

Are we heading for a silver supply deficit? – Historically, supply has outweighed demand. Silver demand is rebounding in a V shape whilst supply continues to be Covid-affected due to pandemic restrictions creating supply chain disruptions.

Exhibit 5 – Global silver mine production vs supply & demand 2010A-2021E

Sources: ACF Equity Research; Silver Institute

Sources: ACF Equity Research; Silver Institute

Commodity squeeze

Throughout the pandemic markets have predominantly concluded that a commodity squeeze is inevitable.

While silver is used in industrial production, it is also a safe haven asset. As inflation continues to rise – latest US data coming in at 7%, EA 5% and the UK 5.1% – investors will rotate into precious metals such as silver as a financial hedge.

When markets are down, retail comes in to buy more silver. Retail can’t break the market but as marginal buyers (vs. large scale industrial users) retail consumers and investors can become the marginal price setters for silver.

Banks are competing to purchase physical silver. In 2021 Standard Chartered bank began buying 1000 oz bars of wholesale silver alongside speculation that it and other banks would continue this strategy into 2022.

Buying directly from the source (i.e., silver producers) could contribute to an actual or perceived supply deficit. By buying up reserves of silver and so absorbing oversupply in the market, financial institutions and investors could become silver price setters.

In ACF’s view, with any financial crisis comes extreme volatility in the markets. However, for reasons we describe in other research notes, the future is likely to always to manifest as a V-shaped recovery in demand rather than U or L shaped.

We also conclude in the same capital markets research that the time it takes for markets to recover is contracting and we forecast that it will continue to contract with every crisis.

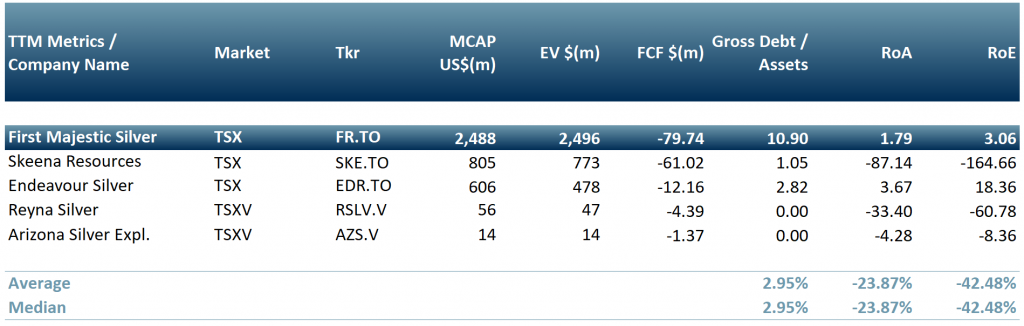

In exhibit 6 below we show a peer group of silver mining companies: First Majestic Siler (TSX : FT.TO), Endeavour Silver (TSX : EDR.TO), Skeena Resources (TSX : SKE.TO), Reyna Silver(TSXV : RSLV.V), Arizona Silver Exploration (TSXV : AZS.V).

Exhibit 6 – Peer group of silver mining companies

Sources: ACF Equity Research Graphics; Refinitiv; Exchange rate: (Source: XE.com) CAD vs USD: 0.7974

Sources: ACF Equity Research Graphics; Refinitiv; Exchange rate: (Source: XE.com) CAD vs USD: 0.7974

Authors: Renas Sidahmed and Christopher Nicholson – Renas is a Staff Analyst and part of the Sales & Strategy team and Christopher is MD and Head of Research at ACF Equity Research. See their profiles here