Egaming gains outlive Covid

As economies reopen, vaccines rollout and individuals begin to spend less time at home, the video-streaming industry is wondering if this is the end of an era of boosted screen and eleisure time. Brendan Brady of Antenna (US company providing media analytics) asks – “Is this now a period of stability? Or are we going to fall off a cliff?”

The data we present below could reasonably be used to infer that egaming and its high-profile sub-sector esports, will contract from recent highs – though a reasonable top line inference, it would be a misreading of the data set.

- During lockdown people turned to their home screens for work and, more notably, for entertainment. A survey carried out in North America, the UK and Australia showed that average full-time employees gained 15% more spare time during the pandemic (MIDiA Research, 2020).

- We infer that 15% spare time gains are an underestimate and suspect the time gain was closer to 25% based upon commute savings alone and ignoring any work-from-home efficiencies.

- As people venture out and commute again, they are spending less of their spare time inside the home, which means less time on screens – Mark Mulligan, Managing Director at MIDiA, is calling this an “attention recession”.

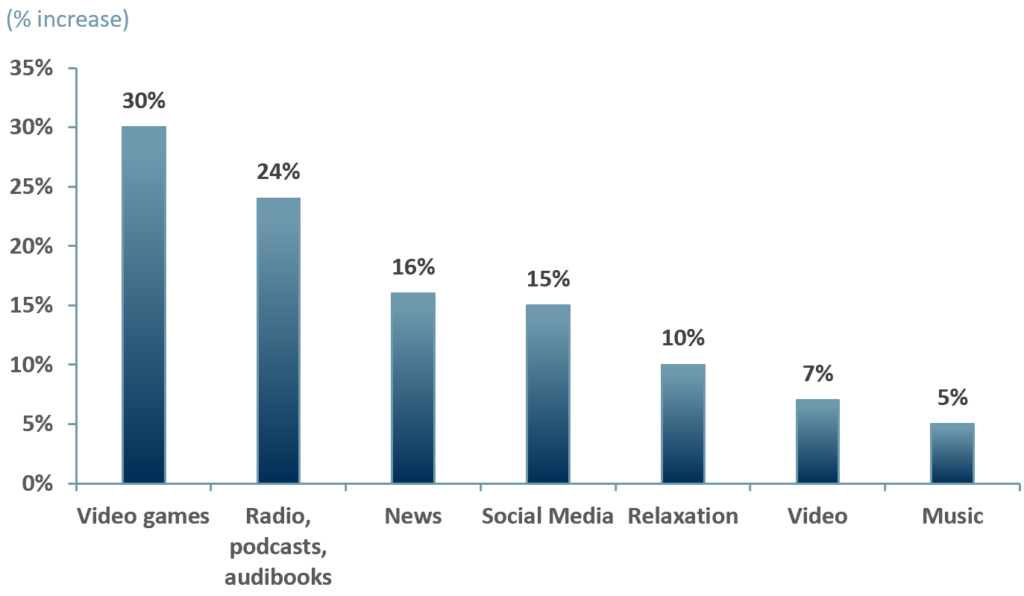

- Between 2Q-4Q20A the largest share of screen use went to the television. For example, video gaming individuals devoted an additional 80min/week or increased their playing time by ~30% (exhibit 1).

Exhibit 1 – Average % increase full-time workers spent on media/entertainment per week 2Q20-4Q20

Sources: ACF Equity Research Graphics; MIDiA Research

Sources: ACF Equity Research Graphics; MIDiA Research

As spare or leisure time again reduces, which one of these habits will outlive the pandemic? The media industry is concerned about a developing attention recession.

The ‘attention recession’

Attention recession comes from ‘attention economics’ a concept theorised by Nobel Laureate Herbert A. Simon – a 1950s US economist. The term ‘attention recession’ was coined in the mid-1990s after the analysis of ‘information consumption’ came into vogue.

Attention economics views attention as a scarce commodity that humans have. Attention economics research suggests that because humans have limited cognitive resources, when an individual’s attention is allocated to a specific task, resources available for other tasks become limited (coincidentally an attack on the idea that humans can parallel process or multi-task high level cognitive activities).

Attention is a cognitive process in which the use of resources is selective. According to Simon, a wealth of information means an inefficient allocation of attention to each of those sources of information.

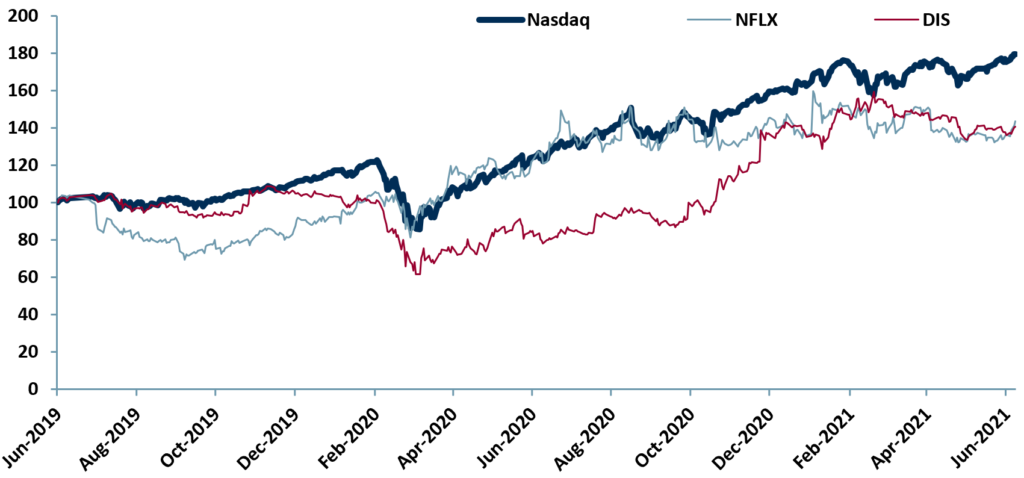

The selective nature of attention is creating scepticism in the media industry that recently observed gains in screen time are sustainable. The media industry evidenced recent decreases in subscription levels to media majors Netflix (Nasdaq: $NFLX) and Disney (Nasdaq: $DIS).

Globally $NFLX paid subscriptions growth came in at 3.98m in 1Q21A, missing the analyst consensus forecast of 6.2m and down vs. 4Q20A’s 8.51m subs growth. Even though $DIS reached a new share price high in 1Q21A with 94.9m total subs, by 2Q21A DIS had booked 104m total subs but below the April consensus forecast of 109m total subs.

NFLX’s share price reached a high of $586 on 20/01/2021 – by 12/05/2021 the share price had fallen 17% to ~$486. Between the 25/06/2021 and 07/07/2021 NFLX’s s/p had regained ~10% to close at ~$541.

DIS’s s/p fell by 11% to $178 on 25/06/2021 vs. its peak on 08/03/2021 of $202. DIS is currently trading around the $175 mark.

When compared to the US Nasdaq leading tech index, both NFLX and DIS have underperformed (exhibit 2).

Exhibit 2 – Price relative video streaming majors vs. main indices 2019-2021

Sources: ACF Equity Research Graphics; Refinitv

Sources: ACF Equity Research Graphics; Refinitv

While video streaming may be flatlining or declining again as economies reopen, the egaming industry is bucking this trend. Egaming or gaming is the act of playing video games – esports, professional/competitive video gaming – is a subsegment of egaming.

Egaming (and esports) continues to flourish

The global video gaming market size is forecasted to reach US$ 267bn by 2025E, up from $156bn in 2020A (Juniper Research, 2021). ACF forecasts that esports will reach $2.2bn in 2025E up from $0.9bn in 2020A.

Egaming platform Roblox reported that in 1Q21A, there were 2x as many hours spent on its platform vs. 1Q20A, at the start of the pandemic. While restrictions are easing there are two generations that do not want to kick the habit of home media entertainment – Generation Z or under 25s (born 1997-2012) and Generation Alpha (born 2010 or after).

According to Bloomberg, globally Gen Z is the largest generation surpassing Millennials and Baby Boomers at 32% of the total population (2.5bn out of 7.7.bn) in 2019.

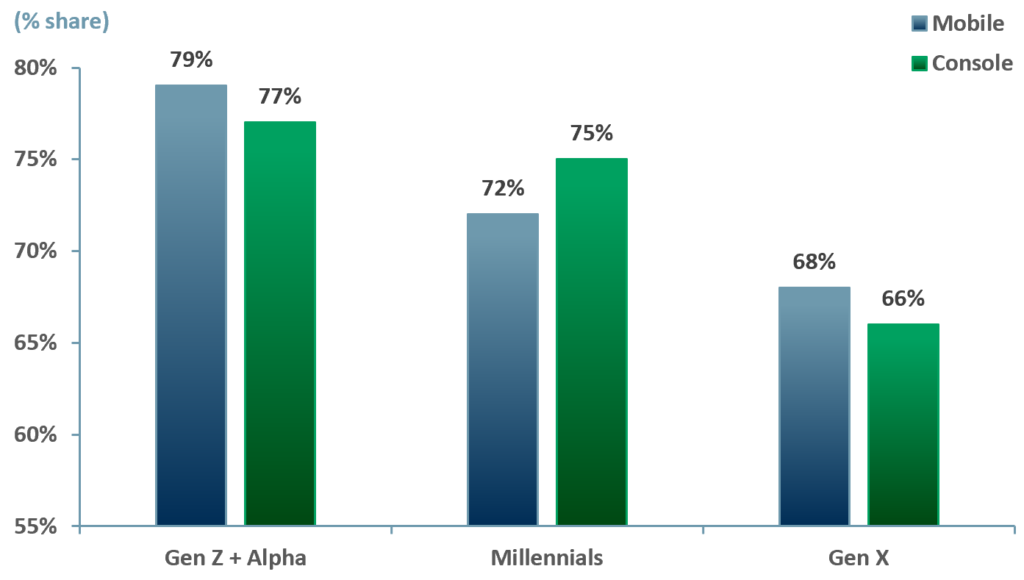

Gen Z and Gen Alpha generations have never known a non-digital world. They have grown up using computers, tablets and smartphones. According to Newzoo, and egaming, esports and mobile data provider, the smartphone/mobile segment makes up 45% of the gaming industry – the equivalent of ~US$ 79bn of the total $175.8bn estimated market value (Newzoo, 2021).

The second most popular segment in the industry is console games, making up 28% or $49.2bn of the egaming sector). In 2020, Gen Z + Alpha made up a combined 79% of mobile users worldwide and 77% of console users (exhibit 3).

Exhibit 3 – % share of global mobile gamers by age group in 2020

Sources: ACF Equity Research Graphics; Newzoo

Sources: ACF Equity Research Graphics; Newzoo

Egaming sub-sector Esports is also rising in popularity on mobile devices. The evolution of smartphone technology, its ever-growing penetration rates, volume based lower costs and increased ease of use is driving the increase in interest from egaming and esports participants. In 2020, it was estimated that 4.8bn people worldwide, more than 60% of the total global population, use mobile phones (emarketer.com) of which ~50% are smartphone users.

By year-end 2021, underlying growth rates suggest there will be a total of ~3bn players globally, up 5.3% y/y – Newzoo expects the geographical mix of egaming (and from which we currently infer esports players) to approximate Asia Pacific 55%, Middle East & Africa 15%, Europe 14%, Latin America 10% and North America 7% (Newzoo, 2021).

Our inference – there is little evidence of an ‘attention recession’ in egaming and or esports, rather the evidence points to continued strong growth.

Author: Renas Sidahmed – Renas is a Staff Analyst and part of the Sales & Strategy team at ACF Equity Research. See Renas’s profile here