EV batteries’ slow mass movement from cobalt

Tesla (TSLA) says it can already do without cobalt in its EV batteries. But cobalt will not be replaced in rechargeable batteries en-masse any time soon.

Driving the substitution of cobalt in favour of other materials:

Electric vehicle (EV) battery makers continue to explore the replacement of cobalt in lithium-ion battery cathodes in 2022 just as they did in 2021. EV manufacturers are concerned about labour practices involved in cobalt extraction, its volatile supply chain structure, scarcity, and its price changes.

Investor ESG focus has also caused EV manufacturers to review cobalt sourcing practices.

Apart from instability within the supply chain, there are also manufacturer and global governmental strategic metals concerns.

China may own up to 70% of production in the leading and dominant global cobalt mining region – the Democratic Republic of the Congo (DRC) and does control 80% of cobalt processing – though these proportions are likely to start to decrease in our view.

Cobalt prices, currently around US$ 70,500/t, appear to be heading towards the 10 year high of US$ 91,599/t achieved in March 2018. Outside of the current rally and the 2018 rally, Cobalt has traded in the range ~US$ 21,500/t – 37,600/t.

EV net margins appear to be in the range 12% to 7.5% and declining, with some expectation that these margins will bottom out around 5% for the average electric car (combustion engine car manufacturer net margins appear generally in the range 10% to 20% and are also falling).

Between 1991 and 2018, lithium-ion cell pricing fell 93% (M.S. Ziegler & J.E. Trancik, Energy Environ. Sci. issue 4, 2021).

- Cobalt (Co) is currently a key component of Li-ion batteries found in in today’s technologies from cell phones and laptops to aircraft and EVs.

- Worldwide in 2020, Cobalt was primarily sourced from mines in the DRC. The DRC accounts for >70% of global production. However, cobalt mining in the DRC is well known for its unethical and unsafe labour practices.

- The ESG implication of cobalt mining in the DRC is perhaps becoming more important than the price and supply volatility impacts for EV manufacturers.

- Because of the reputation of DRC mining practices, cobalt is becoming increasingly unattractive not just to investors but to consumers too.

- Several EV battery manufacturers are developing non-cobalt-based Li-Ion batteries. Among those are Tesla (NasdaqGS: $TSLA), Panasonic (Tokyo: $6752.T) and General Motors (NYSE: $GM).

- Other cathode technologies, such as lithium iron phosphate (LFP) and nickel iron aluminium (NFA) are showing considerable energy density promise. Some innovators are claiming there is no downside and considerable upside in energy density and production cost.

- LFP and NFA cathodes combined with solid state electrolytes, may also deliver greater safety (liquid electrolytes operate safely only at lower temperatures compared with solid state electrolytes).

So why do we think there is little immediate threat to cobalt as a key component in lithium-ion batteries and so to global cobalt demand and rising cobalt prices?

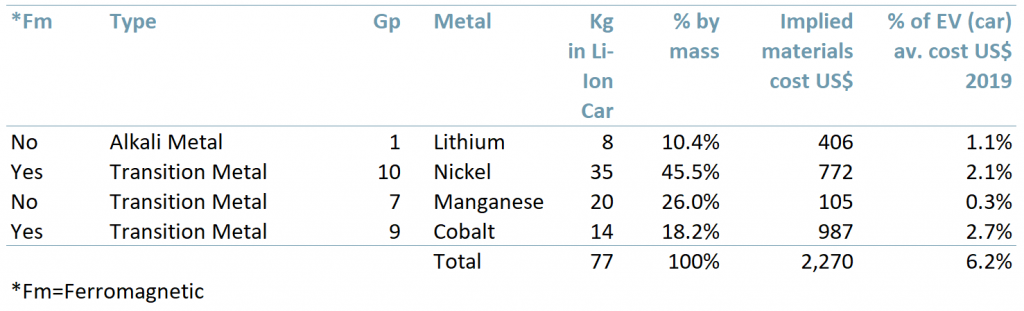

In the exhibit below we use a generalised ACF Equity Research model to examine indicative cost implications of cobalt in nickel manganese cobalt NMC cathode lithium-ion batteries.

The cost of cobalt could suggest a strong margin driver for cobalt substitution at today’s prices (however much less so at the average cobalt trading range over the last decade).

If EV car manufacturer net margins are trending down towards 5%, then recouping 1-1.5 percentage points of net margin could equate to a 15-45% net margin improvement, according to our estimates (note that there is still an expected cost to a substitute material).

Savings in the order of 30% could be generated on EV battery production by substituting cobalt for other materials at current prices.

For the consumer, our model suggests that the cost of cobalt accounts for between 2-3% of the average selling price (ASP) of an electric car – in our view manufacturers can easily pass this cost on to the consumer.

The car is such an iconic purchase in the mind of the consumer that we would not expect meaningful substitution effects until cobalt or other materials pushed up EV ASPs by 10%.

Therefore, we conclude that investor emphasis on ESG is the biggest driver to finding a cobalt substitute for lithium-ion battery cathodes over the next 8-10 years.

Exhibit 1 – Generalised model for contribution of cobalt at today’s prices to the 2019 ASP of an electric car

Sources: ACF Equity Research Estimates

Sources: ACF Equity Research Estimates

Cobalt reserves and uses:

Cobalt (Co) is a hard, lustrous, grey metal with a high melting point (1493°C) and is 32nd in global (crustal) abundance (notwithstanding that far less is concentrated in currently economic reserves). Cobalt economic reserves worldwide in 2020 totalled 7.1m Mt, of which the largest proportion is the DRC (3.6m Mt), followed by Australia (1.4m Mt), Russia (250k Mt), Canada (220k Mt), and China (80k Mt).

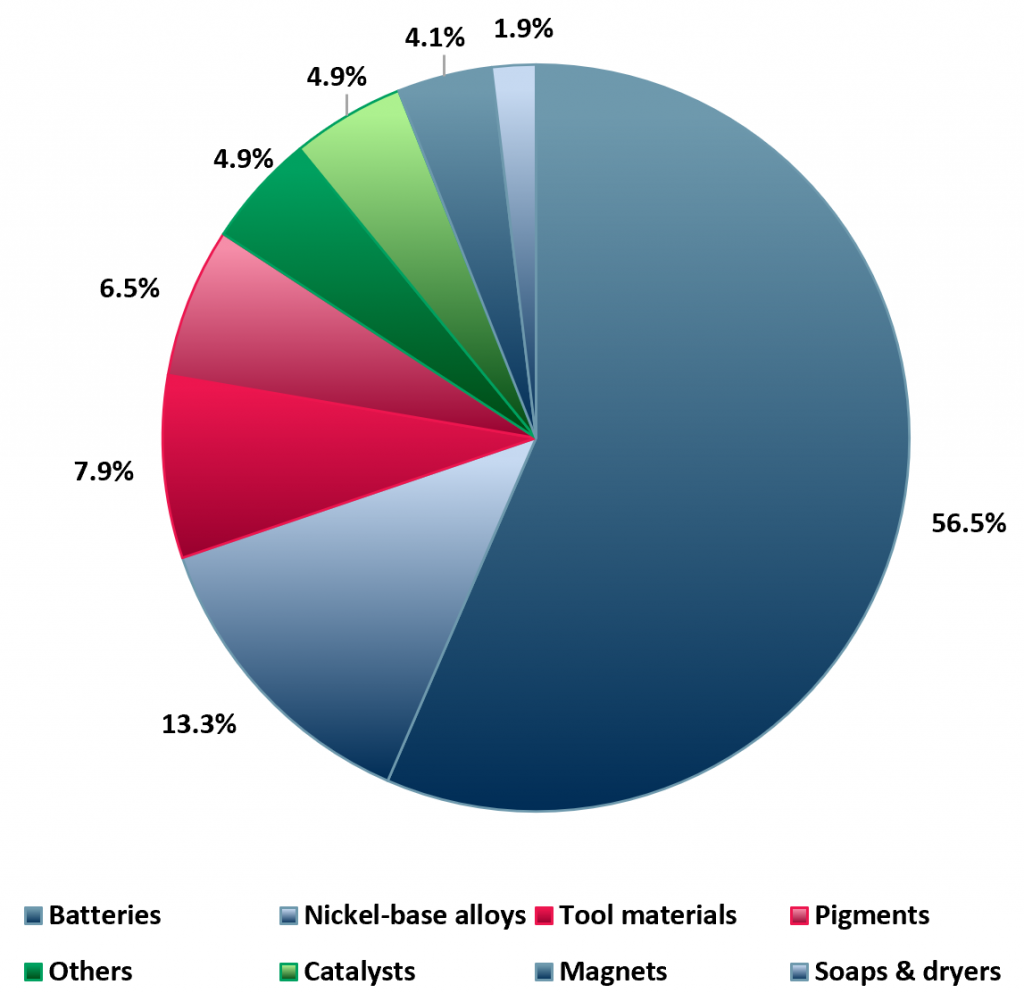

Although EV battery cathodes account for around 56% of cobalt consumption, as per exhibit 2 below, in 2020 about 58.6 kilo tonnes of cobalt, or around 30% of consumption, were used in applications such as:

- super alloys for gas turbine blades and jet aircraft engines, (13.3%)

- catalysts (4.9%)

- carbides, diamond tools (7.9%) and magnets (4.1%)

Exhibit 2 – Consumption of cobalt – % distribution by application in 2020

Sources: ACF Equity Research Graphics; Cobalt Institute

Sources: ACF Equity Research Graphics; Cobalt Institute

A typical lithium cobalt oxide battery requires between 4 – 30kg of Co, dependent on battery size. A regular battery for an EV car needs 10-15kg of Co vs. 10g for an iPhone battery.

Cobalt demand will ensure a tight demand supply dynamic for at least the next decade and prices will rise

Cobalt seems to be the blood diamond of the EV batteries. Most of today’s electric vehicle batteries use nickel-manganese-cobalt cathodes, with 60% nickel and 20% each of manganese and cobalt (our generalised model above assumes a ratio closer to 50%, 30%, 20% respectively).

Researchers and analysts have been pushing nickel up to 80% and bringing manganese and cobalt down to 10% each. As a result, cobalt content in EV batteries has been falling in recent years.

Nevertheless, we conclude that this improved efficiency in the use of cobalt is insufficient to compensate for the supply and demand gap driven by EV growth (and other uses).

According to a 2020 research paper from Oak Ridge National Laboratory, there are several potential replacements for cobalt-based cathodes within Li-Ion batteries, such as LFP and NFA. Solid state electrolytes also look promising in terms of raising energy density and so the possible driving distances between charges (range).

But…these technologies are still in pre-car testing phase (though some are close to in-car testing).

Manufacturers will want and need to test many facets of these substitute cathodes, not least of which are safety, possible re-tooling investment and rollout, possible process change and supply change management. This all takes both time and capital.

By way of analogy PI and PII drug trials (safety and re-testing efficacy in real life) prior to FDA and EMA approval are in the order of 6-7 years, igniting the marketing machine and adoption, another 1-2 years. Again, we infer that we are a decade away from any real threat to the underlying rise in cobalt demand – the potential mass adoption substitutes for cobalt in cathodes are still in the equivalent of the pre-clinical phase.

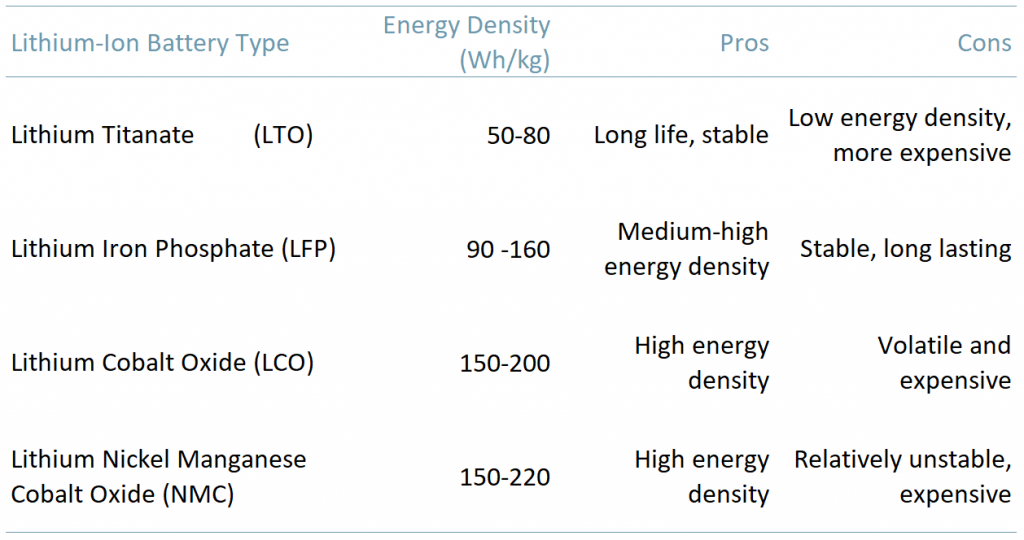

In the exhibit below we provide a comparison of some of the new non-cobalt cathode technologies (LTO, LFP, LCO) vs. massed produced NMC cathode lithium-ion batteries.

The novel cathodes compared with NMC (below) have been designed to be fast charging, energy dense, cost effective, and longer lasting. Nevertheless, these cathodes provide different energy densities and, we argue, remain uncompetitive with NMC, for now.

Exhibit 3 – Density energy comparison between different types of Li-ion cathodes

Sources: ACF Equity Research Graphics; Flux Power

Sources: ACF Equity Research Graphics; Flux Power

Lithium-ion battery solutions with higher energy densities than NMC and significant enough cost benefits to begin to displace cobalt are probably at least a decade away from mass adoption. One market estimate suggests that 20% of all EVs will have non-cobalt cathodes by 2030.

The same forecaster expects high-performance and long-range vehicles to continue to use cobalt (NMC) cathodes for the foreseeable future.

In the meantime, in common with many forecasters, we expect EV sales to show very strong growth over the next decade.

We conclude that all these factors point to rising cobalt demand over at least the next decade. Bringing new mines into production from a first prospecting step is often a decade process. This deposit identification and development time lag suggests to us that the supply demand gap is only likely to widen which, if we are correct, will only serve to push cobalt prices higher.

We accept that the proposed trend towards Co replacement in cathodes is now well founded and underway. It also seems axiomatic that the EV segment will remain the dominant user of cobalt (around 56% of supply in 2020) for at least the next decade. We also expect the overall use of rechargeable li-ion batteries in technological innovation to continue to grow.

Cobalt supply and demand schedule:

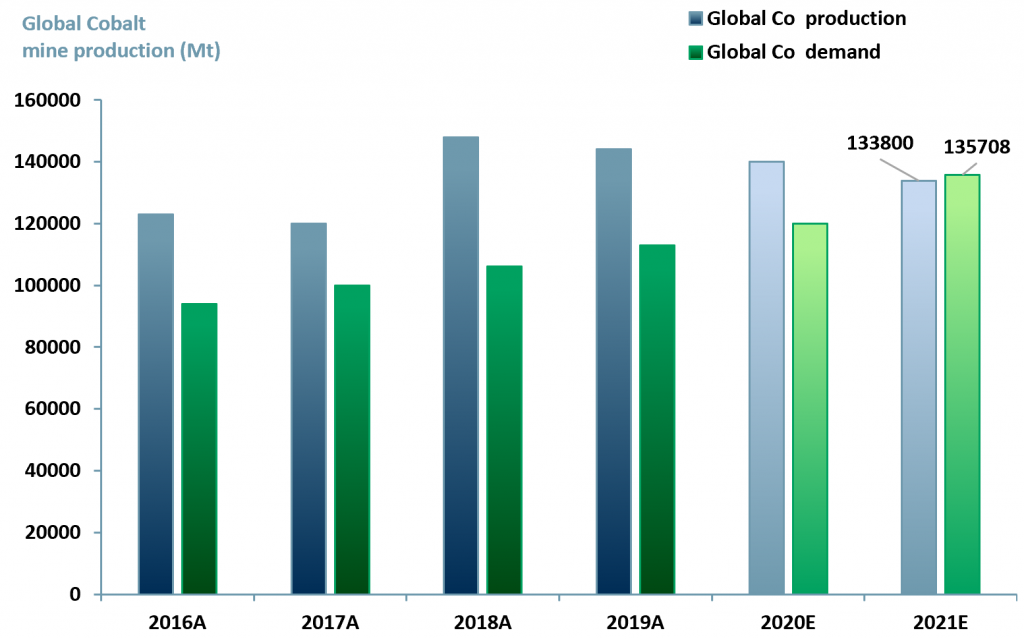

According to Darton Commodities, global cobalt production in 2021E is forecasted to reach 130,000+ tonnes (t) as per exhibit 4 below.

Exhibit 4 – Cobalt mine production vs. cobalt consumption worldwide 2016A-2021E

Sources: ACF Equity Research Graphics; Adroit Market Research; Global Energy Metals; McKinsey

About 110,000t of cobalt production is expected to come from the DRC in 2021. The consensus projected production of Co from the DRC is ~ 150,000t by 2025. The major driver for cobalt demand will remain rechargeable batteries.

In the DRC, Glencore (LSE: $GLEN.L) exploits Mutanda Mine – the world’s biggest cobalt mine. Mutanda production was suspended in 2019 but GLEN has signalled that Mutanda will return to production early in 2022. Glencore is among the top five cobalt producers worldwide alongside China Molybdenum (HKEX: $3993), Fleurette Group, Vale (NYSE: $VALE) and Gecamine S.A.

There are also other cobalt producing companies from Australia and Canada that have a chance of performing well in the global cobalt market, but part of the investment selection process for investors should include a good look at their ESG delivery.

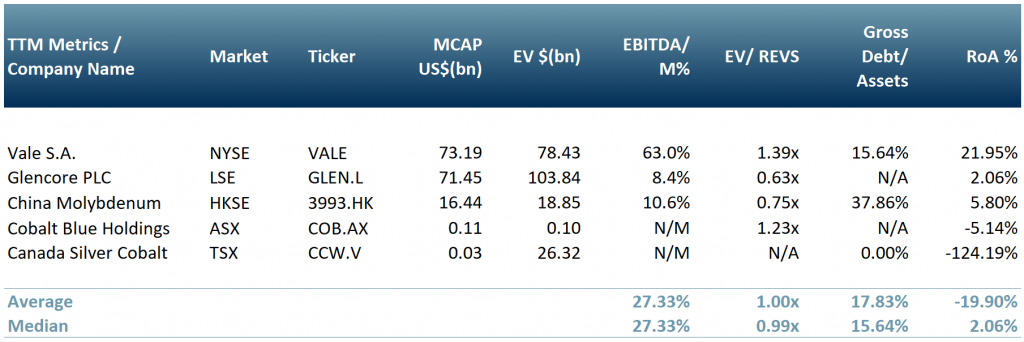

Exhibit 5 – Peer group of cobalt producers

Sources: ACF Equity Research Graphics; Refinitiv; Notes: XE.com currency: CAD vs USD:0.785; CNY vs USD:0.1572; BRL vs USD:0.1863; GBP vs USD:1.3435; HKD vs USD:0.1282; AUD vs USD: 0.7048;

Sources: ACF Equity Research Graphics; Refinitiv; Notes: XE.com currency: CAD vs USD:0.785; CNY vs USD:0.1572; BRL vs USD:0.1863; GBP vs USD:1.3435; HKD vs USD:0.1282; AUD vs USD: 0.7048;

The monthly futures price for cobalt worldwide jumped from $41,200 per metric tonne (t) in January 2021 to above $50,000 by August. The decade high price for cobalt was achieved in 2018 at >$90,000 per metric tonne, which reflects the skyrocketing demand for the metal, boosted by increasing sales of EVs in Europe, China and the US. (Investment Monitor, Trading Economics, 2021).

In our view, all cobalt miners including juniors should consider their own version of the Kimberley Process (KP) adopted by the diamond industry to counteract Africa’s blood diamonds issue.

The Kimberley Process (KP) helped to reduce the flow of conflict diamonds and helped ease investor and public concerns. ESG investors are signalling that something analogous is required for cobalt – in our assessment ignoring this trend is a far greater risk to cobalt demand than substitution effects caused by rising cobalt prices, making ESG investors more important than price substitution effects.

Author: Anda Onu – Anda is part of ACF’s Sales & Strategy team. See Anda’s profile here