EV Battery Vertical Integration – the Automakers’ Solution?

Net zero targets and call from policymakers to move towards cleaner transportation has led to an increase in focus on electric vehicles (EVs). Automakers cannot produce electric vehicles without access to battery metals (currently lithium, nickel, and cobalt).

Fear of missing out (FOMO) is pushing automakers to lock in supplies of minerals for electric vehicle batteries. We forecast that automakers will turn to vertical integration for electric vehicle batteries in the coming years.

- EV battery metals include nickel, lithium, and cobalt. These metals face medium-term supply challenges with concerns growing that there may not be enough raw material to meet the demand for EVs.

- Carmakers have already been partnering up with battery metals suppliers under direct off-take agreements.

- Automakers are examining buying equity stake in miners, which will get them involved directly in financing the digging of actual mines (and possibly in prospecting and exploration). This comes with attendant investment risk.

Automakers ramp up EV battery metals mining investments

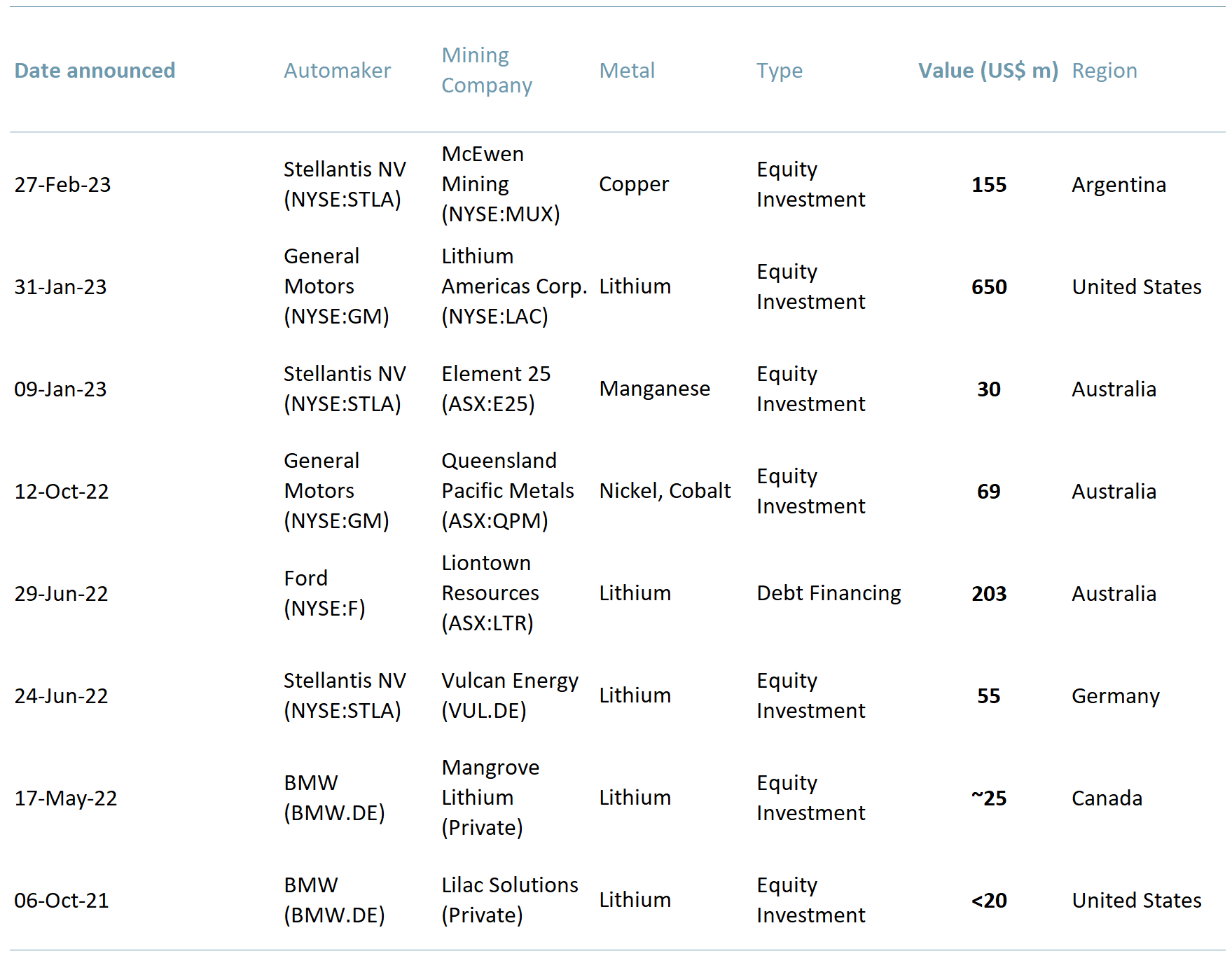

Automakers such as General Motors (NYSE:GM), Ford (NYSE:F), BMW (BMW.DE), Stellantis NV (NYSE:STLA) have committed large investments in direct financing of mines. General Motors announced a $650m investment in Lithium Americas Corp. (NYSE:LAC, MCAP ~$3.5bn) to help it build a mine in Nevada, USA.

The deal will give GM exclusive access to lithium produced from the mine. General Motors is also said to be vying for a stake in Vale SA’s (NYSE:VALE, MCAP ~$65bn) base metals unit.

Tesla (Nasdaq:TSLA) is also planning to make further investments in the lithium supply chain. In 2022 TSLA entered into a 5-year supply agreement with Liontown Resources (ASX:LTR, MCAP ~AS$6bn, ~US$4bn) to provide the EV giant with 100,000+ tonnes of lithium spodumene concentrate/year beginning in 2024.

At the beginning of 2023, Tesla started construction of a $375m lithium refinery in Texas, USA. Tesla plans to begin producing lithium by the end of 2023. There have also been reports that Tesla is considering purchasing Sigma Lithium (Nasdaq:SGML, MCAP ~$4bn), a Brazilian mining company, for ~$3bn (Bloomberg), though the stock is now trading at a ~33% premium to the rumored bid price.

While the main focus is on lithium miners, French-based automaker Stellantis NV (NYSE:STLA) announced a 14.2% stake in McEwen Mining (NYSE:MUX, MCAP ~$400m), which owns the Los Azules Copper project in Argentina. The $155m investment helps secure STLA’s estimated copper demand beginning in 2027.

Copper is an important component of EV batteries. According to the International Energy Agency (IEA), lithium-iron-phosphate batteries, which account for majority of the EV market, require ~53.2 kg of copper per vehicle, which is more than nickel (39.9 kg), manganese (24.5 kg) or cobalt (13.3 kg).

Exhibit 1 – Major automakers mining deals

Sources: ACF Equity Research; FT; Company websites. Exchange rate: (Source: XE.com); EUR vs USD: 1.1062; AUD vs USD: 0.6756

Sources: ACF Equity Research; FT; Company websites. Exchange rate: (Source: XE.com); EUR vs USD: 1.1062; AUD vs USD: 0.6756

Vertical integration

Western automakers are taking action to secure supply. Western automakers can no longer rely on sourcing raw materials off-the-shelf given intense competition for resources. Benchmark Mineral Intelligence predicts a severe shortage of lithium by the end of this decade.

The IEA forecasts that 50 new lithium projects will be required by 2030 to cater to the demand. This is a huge challenge especially given that a mining project could take 15 years or more to become operational.

Furthermore, China’s dominance in the Li-ion battery supply chain controlling more than 50% of battery-grade metals refining capacity across all key materials is unnerving for carmakers (BloombergNEF). Therefore, we expect car manufacturers to vertically integrate their operations, from mine to product, in order to build strategic positions in supply chain management.

However, the move upstream has its own set of risks. Mining projects are risky given the large upfront capital investment required with no guaranteed outcomes, i.e. it is a zero-sum game. Often, projects have a history of running over budget and not meeting production timelines. The motor industry has relatively little experience of managing such risks.

Whereas we applaud the strategic move by autos, we are doubtful that the autos sector has the required skill set at this time to manage the attendant risks of vertical integration into mining. We are also doubtful that the environment at large autos is attractive to mining professionals. This suggests a high degree of cultural change will need to be embedded to make the strategy work effectively enough for investors.

Running mines requires a certain expertise and mindset, which is quite different from manufacturing cars:

- Raw materials: While a mine extracts raw materials from the ground, car manufacturers use raw materials to produce vehicles.

- Production: In order to produce raw materials a mine involves drilling, digging, blasting and processing of the extracted materials, i.e. a more laborious process. A car manufacturer typically uses a fully automated assembly line to produce the final product, i.e. a finished car.

- Workforce: Running a mine requires individuals with a certain appetite for risk as well as specialised skills, e.g. engineers and heavy machinery equipment operators. Car manufacturers require individuals with diverse skills, e.g. engineers, designers and production workers.

- Equipment: Running a mine requires heavy equipment, e.g. bulldozers, excavators and trucks. Car manufacturing involves high levels of automation and software planning for activities and equipment such as welding machines, conveyor belts and other robotics.

- Environmental impact: Mining has a particular set of environmental impacts related to the extraction of minerals and other resources from the ground. Mining can also create local air and water pollution, as well as habitat destruction. Car manufacturing does produce waste and emissions, but car manufacturing plants tend to have a lower local environmental impact. Automobiles themselves (fossil fuel powered) have significant impact but the impact is typically far more distributed.

Running a mine and running car manufacturing do have top level commonalities. Both involve the production of goods, but the management skills, processes, materials, workforce, equipment and environmental impact are significantly different, in our view.

Investors should consider these risks, i.e. the significant diversification implied for Auto operations and the cultural change required by Autos to make a success of significant investments in the mining supply chain.