The future of Lithium – outlook

Lithium carbonate prices have created a lithium boom for miners and generated concerns over battery metal supply. Lithium demand use is dominated by hybrid electric vehicles (HEV) and electric vehicles (EV). HEV and EV automakers account for 70% of the battery metal’s demand.

Lithium demand

- Lithium is heading for a structural supply deficit because mining and refining companies are struggling to keep up with demand.

- Benchmark Mineral Intelligence expects lithium carbonate equivalent (LCE) demand 2021 to reach 398k metric tonne (mt). This LCE demand forecast may point to a lithium supply deficit for 2021 of between 25k and 50k mt.

- Data from WoodMac and UBSe suggests the market is in supply/demand equilibrium today but that the situation is set to deteriorate henceforth, in favour of a significant structural supply deficit from 2029 onwards.

- Lithium demand for battery metal use is only likely to grow. This is because the HEV and EV auto sectors are not the only ones transforming the demand equation fuelling a lithium boom.

- Lithium as a battery metal is good at both small scale (autos) and large scale (electricity grid) power storage. Therefore, the growth in renewable energy sources powering the electric grid and its need for grid-scale battery storage is also driving the lithium boom.

- Aircraft manufacture and healthcare sector growing lithium demand (not for battery metal usage) adds a further element to the expected lithium demand explosion.

Lithium supply

- In 2020, global processed lithium was 345k mt. Mines produced 82k mt in 2020 up 140% vs 2010.

- Albemarle (NASDAQ: $ALB, MCAP ~30bn) is the leading lithium specialty chemicals company in the world and is set to double its lithium capacity by 2025 at its Silver Peak lithium production facility in Nevada.

- Lithium is extracted from lithium brines. Lithium brines are accumulations of saline ground water in which lithium becomes concentrated over geological time. Lithium brines come in three distinct geological types: 1) pegmatite, 2) continental brines and, 3) hydrothermally altered clays.

- Lithium mined supply is dominated by just five mines in Western Australia, which account for 60% of global mined lithium brines.

- However, recent discoveries and innovations in lithium mining may increase mined lithium supply dramatically and reduce Western Australia’s dominance over the next decade.

- China dominates both lithium processing and lithium battery production with over 100 gigafactories.

- Europe and the US auto manufacturers are belatedly focussing on li-ion battery production gigafactories, viz Tesla (NasdaqGS:TSLA) et al. However, it will be some time before the US and Europe will be able to pose a challenge to China’s battery supply dominance.

- Lithium only accounts for around 7% by mass of L-ion batteries. Whilst lithium batteries are unlikely to be superseded technologically or energetically in the next decade, after that the picture is less certain.

Lithium price development expectations

- China-based company, Ganfeng Lithium Co., the third-largest producer / supplier of lithium chemicals, claims that lithium boom will push the metal to new record highs as the lithium market tightens.

- China Lithium carbonate (Li2CO3) battery grade reached a 10-year high in 2018 of US$ 17,000 mt. The China Li2CO3 battery grade price is back on the rise, recently exceeding US$ 14,200 mt.

- High lithium prices in China reflect tight supply, strong demand, and low inventory.

- Ganfeng Lithium Vice Chairman Wang Xiaoshen is preparing to capitalise on the lithium battery metal boom whilst admitting it will take time to deliver new supply.

- Wang also said that Ganfeng will step-up efforts in lithium resource exploration to meet expected market demand.

- Both renewable energy grid-scale storage and HEV/HV auto lithium demand are underpinned by consumer demand, investor sustainability requirements (ESG) and political and financial markets will (COP 26).

- In the shorter term, the future for lithium for investors and suppliers looks promising, with all eyes on greener energies, governments’ net-zero-emission targets and increasing sales of EVs.Our analysis suggests an investment opportunity remains in lithium companies, aligned with global environmental goals.

Lithium investment proxies

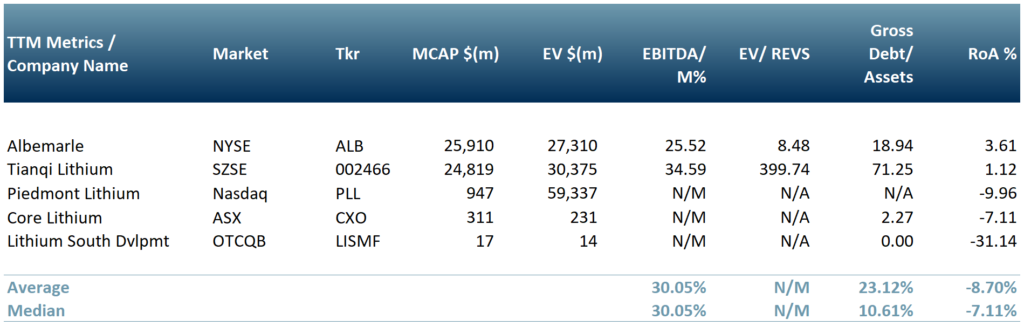

In Exhibit 1 below, we have selected a peer group of five Lithium producers and exploration companies: Albemarle (NYSE : $ALB) – producer, Tianqi Lithium (SZSE : 002466) – producer, Piedmont Lithium (Nasdaq : $PLL) – explorer, Core Lithium (ASX : $CXO) – explorer and Lithium South Development (OTCQB : $LISMF) – explorer.Exhibit 1 – Peer group of lithium producers

Sources: ACF Equity Research Graphics; Refinitiv

Sources: ACF Equity Research Graphics; Refinitiv

Lithium uses market breakdown

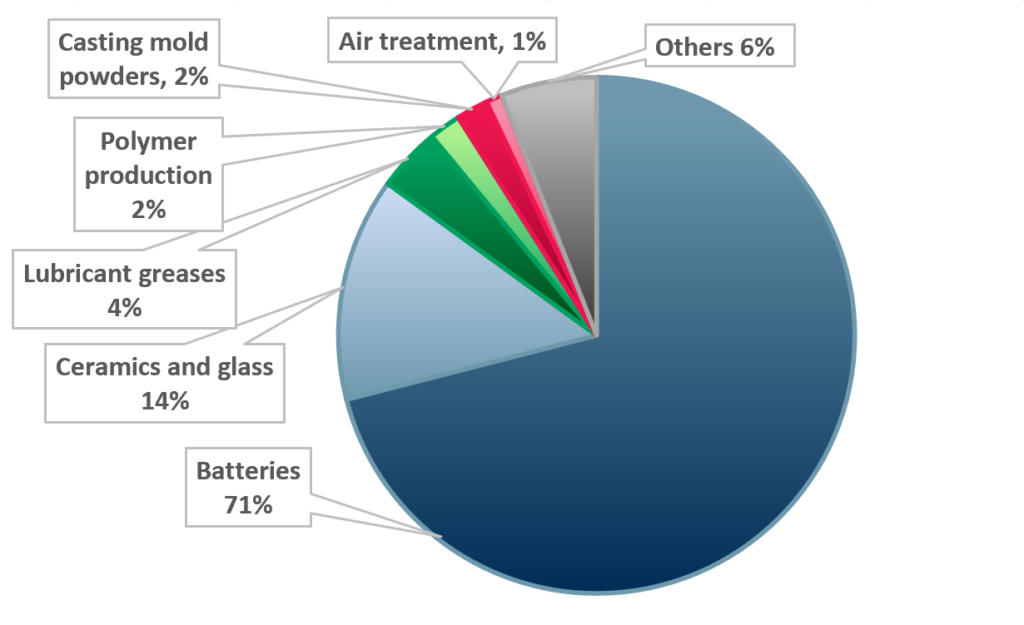

71% of the lithium produced globally is used to make Lithium-ion batteries. Other lithium usages from ceramics and glass to air treatments are a relatively insignificant proportion of demand compared to Li-ion batteries (exhibit 3).

The surge in battery demand will boost lithium consumption in the future but again, lithium miners will need to catch up with production and growing demand, otherwise there is a strong danger that research will accelerate to find substitutable goods or technologies.

Exhibit 2 – Global lithium usage by application 2020

Sources: ACF Graphics; US Geological Survey 2021

Sources: ACF Graphics; US Geological Survey 2021

The future of lithium recycling from Li-ion batteries

Currently market commentators view the recycling of lithium-ion batteries as irrelevant to supply (cf. auto catalyst recycling to recover PGM). Australia recycles 2-3% of Li-ion batteries and does it offshore. China is thought to have produced 500k mt of used Li-ion batteries. Most Li-ion batteries currently end up in landfill.

ACF Equity Research takes a different view to the market

Li-ion battery producers should prepare to optimise their plants and infrastructures. Lithium production optimisation should take place for two reasons:

1) to increase lithium battery metal production.

2) to create and or adapt recycling centres to process Lithium-ion batteries as effectively as possible.

For Li-Ion battery producers it may also be necessary to take far tighter control of the entire supply and consumption chain to maximise recycling of lithium.

The Lithium recycling process is difficult, but we think that a demand for this service will increase in line with rapidly accelerating demand of HEV, EV and grid scale batteries for renewable energy producers.

The challenge for lithium battery recycling divisions or companies is to make the process profitable.

We are not alone in contrarian view on lithium battery metal recycling:

Canadian start-up Li-Cycle uses a combination of mechanical size reduction and hydro-metallurgical resource recovery techniques to recycle Lithium, with technologies that are safe and have minimal greenhouse gas emissions.

Comstock Mining (NYSE: $LODE), a mineral explorer and producer, secured the rights in Feb 21 to a majority equity stake in LINICO Corporation (’LiNiCo’) a lithium-ion battery recycling company that itself recently acquired a battery metal recycling facility from Aqua Metals (NasdaqCM:AQMS) in Nevada.

We believe that solutions and different business models will emerge from an increase in lithium recycling needs.

Following Comstock’s $LODE example, other mining companies may start acquiring or building their own recycling plants.

We assess that there is a case for mining companies leasing rather than selling the lithium they produce. So, the model becomes lithium-as-a-service.

There seems to be some consensus that lithium ion batteries can complete some 500 or so charging cycles before they require recycling.

At the point at which a lithium ion battery reaches the end of its life, we propose in our lithium-as-a-service model that batteries must be returned to their owners – the mining companies.

In this way, mining companies would always own, and control, the lithium asset. Our model makes for interesting tangible asset balance sheet growth and valuation analysis. Our model also suggests an increase in working capital requirements.

Lithium-ion battery capacity has increased tenfold in the past decade, according to a report from the International Energy Agency (IEA). If the IEA and supply pessimists are correct, the solution to a significant lithium structural supply deficit will require out-of-the-box thinking to feed and support lithium demand.

We foresee many opportunities in the lithium market for investors and for mining companies to extend their business models.

Our investment case is underpinned by an expected significant structural lithium supply deficit. Our investment case for lithium may be enhanced by popular, institutional investor and political opinions coalescing in relation to the environment.

Authors: Anne Castagnede, Renas Sidahmed, Christopher Nicholson – Anne leads the Sales & Strategy Team, Renas is a Staff Analyst and part of the Sales & Strategy Team, Christopher is MD and Head of Research at ACF Equity Research. See their profiles here