Improvements in electricity access in Tanzania

Much of sub-Saharan Africa does not have sufficient access to electricity today. This lack of electricity is due to underinvestment and a deficiency of resources and population density in many areas.

Key Points:

- The International Energy Agency (IEA) estimates that in 2019, 52.1% (~600m) of sub-Saharan Africans (SSA) did not have access to electricity. This is ~75% of the total global population of individuals without access to power.

- >30 countries across Africa, mainly in sub-Saharan Africa, suffer electricity outages whenever demand outstrips supply.

- This shortage of electricity across sub-Saharan Africa is a major limiting factor to Gross Domestic Product (GDP) and investment. In broad terms it has a significant impact on quality of life, corporate productivity and overall economic output.

- In 2019 annual GDP growth in North Africa, where >98% of the population has access to reliable power, was 3.1%. This is 0.8% higher than in sub-Saharan Africa where annual GDP growth was 2.3%, even over a half-decade such growth differentials make a significant difference in economic wealth.

In developed countries, access to electricity or a reliable power source is generally now only an environmental question. In developing regions such as sub-Saharan Africa limits economic growth in many ways, including its overall impact on health and education.

In sub-Saharan Africa it is estimated that half of secondary schools (ages 12yrs and up) and ~60% of healthcare facilities do not have access to reliable power sources (Journal of Global Health, 2021).

A lack of power in healthcare facilities is potentially disastrous in slowing down the vaccination rollout or undoing the vaccination programme to date. C-19 vaccines require an efficient cold chain management system or UCC (Ultra Cold Chain) storage. If significant populations remain unvaccinated this provides a seat of disease for the inevitable development of new variants that may side-step current vaccines.

The typical vaccine cold chain requires vaccines to be held at a temperature range of 2°C to 8°C (36°F to 46°F), this is the case for the AstraZeneca (NasdaqGS:AZN) vaccine.

The Ultra Cold Chain (UCC) range is between -70°C and -20°C (+/-10°C) – (WHO, 2021). Maximum shelf-life if stored properly in a freezer is ~six months.

Pfizer’s (NYSE:PFE) vaccine was originally subjected to UCC conditions. However, very recently a recent brief from the US FDA on 19 May 2021 authorized the Pfizer vaccine to be stored at standard refrigerator temperatures (2°C to 8°C) for up to one month after thawing from UCC temperatures. All the same, maintaining 2-8°C is still a challenge in anyone’s summer, without consistent electricity supply.

Without improved electricity infrastructure in place, sub-Saharan Africa’s Covid outlook remains acute. While the stats on the number of Covid cases in SSA are low (perhaps deceivingly), this has been linked to a lack of testing due to price and accessibility. We surmise with others, that there is also a likely lack of accurate, or sometimes any, reporting.

The World Bank predicts that the economic fallout of Covid-19 has caused sub-Saharan Africa to enter its first recession in 25 years with a GDP decline of -3.3% in 2020. The cost of this downturn could reach US$ 115bn in output losses and could push 40m people into extreme poverty (i.e. individuals living on less than US$ 1.90/day).

Access to power is a key factor in whether each individual sub-Saharan Africa nation will rapidly recover from the C-19 induced recession. This is evident in some SSA nations like Tanzania, for example. Tanzania is Africa’s sixth most populous country with ~61.3m people in 2021 – ~4.5% of the total population of ~1.37bn in Africa.

Note that Sub-Saharan Africa is >7.4x bigger by square miles than India. The population of Sub-Saharan Africa in 2021 is estimated at ~1.13bn and for India in 2021 is estimated at ~1.39bn by sources using United Nations data. These land area and population statistics point to the population density challenge vs. electric grid infrastructure capital investment.

Over the past decade Tanzania has made good progress in improving and expanding its electricity grid and increasing generation capacity. As a result, the population with access to power increased to ~21.5m (37%) in 2018, up 15.1m or 26% vs 6.4m (11%) in 2000. The next target for the government is to have universal access to power by 2030.

Tanzania, like many African nations, is rich in natural resources. This includes, but is not limited to – gold, iron ore, nickel, diamonds, uranium, natural gas and coal. Coal is one resource which the government is keen to take advantage of to improve access to electricity.

Tanzania has coal resources of ~1.9m tons and reserves of 304m tons but currently does not generate any power from coal. To take advantage of these resources the government is planning to develop 2,900 MW of coal fired power generation by 2025 (International Trade Administration, 2020) – this would generate enough electricity for ~1.2m households/year.

There are currently nine coal projects that have received initial permits in Tanzania. Five of which are a collaboration between state owned companies and the private sector. These companies include Kibo Energy ($KIBO:L), Edenville Energy ($EDL:L), Intra Energy (ASX: $IEC) and a Chinese state owned company named Sichuan Hongda.

Kibo Energy ($KIBO:L) is a key player in the coal power market in Tanzania – planning to develop a co-located coal mine and thermal (coal) power plant. The plant will initially have a capacity of 300 MW (~120k households) with a long term scalability to 1000 MW (~400k households), if there is further demand.

The Kibo management strategy is to continue to work with Tanzanian authorities in order to develop the mine asset. Other options are also under exploration that could involve a Tanzanian export power market – selling electricity to Zambia and Kenya – and gaining access to other South African energy markets.

The timescale for the Kibo Energy project was, for a while, delayed by unstable political concerns surrounding the Tanzanian government. However, following the Oct 2020 elections and the election of a new president, the Kibo Energy team believes that the government is softening its stance and hopes that the projects will continue in due course.

In the meantime Kibo is developing 7 WTE projects in South Africa in collaboration with South Africa based Industrial Green Solutions. Kibo will own 65% of the company Newco Energy which is set up to own the waste to energy (WTE)project portfolio.

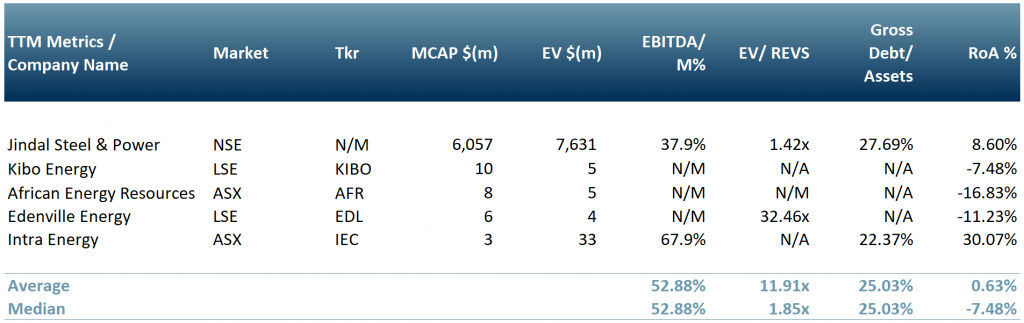

Exhibit 1 shows five companies working to increase the supply of electricity across sub-Saharan Africa. Kibo Energy ($KIBO:L), Edenville Energy ($EDL:L) and Intra Energy (ASX: $IEC) are all working in the Tanzanian coal power sector. Jindal Steel and Power ($JINDALSTEL: NSE) plans to operate in the coal power market in Senegal and African Energy Resources (ASX: $AFR) has an interest in the Botswana coal power market.

Exhibit 1 – Peer group of five companies working in the coal power sector in sub-Saharan Africa

Source: ACF Equity Research Graphics; Exchange Rate: (Source: XE.com) GBP vs USD 1.40995; AUD vs USD 0.77547; INR vs USD 0.013641.

Source: ACF Equity Research Graphics; Exchange Rate: (Source: XE.com) GBP vs USD 1.40995; AUD vs USD 0.77547; INR vs USD 0.013641.

Access to electricity across sub-Saharan Africa remains a cause for concern but is improving. As governments look to take advantage of natural resources and collaborate with the private sector, opportunities are opening up for companies to step into a market with very few, if any, competitors.

As the countries and economies in sub-Saharan Africa continue to develop, albeit at a slower rate than North African economies for now, demand for electricity will continue to rise. Grid infrastructure investment will rise in order to spur further economic growth.

Those companies that entered the markets early, establishing power assets and connections with local governments, can take advantage of this as electricity transmission infrastructure and or electricity strategies improve across the continent.

Author: Sam Butcher – Sam is a Junior Staff Analyst at ACF Equity Research. See Sam’s profile here