UK’s EV battery industry emerges

Britishvolt, plans to build the UK’s first gigafactory in 2021E, to enter the EV battery industry. Blyth was chosen as a strategic position for the factory due to its international electricity grid connection.

Key points:

- Britishvolt was founded in December 2019 and has already gained support from Middle Eastern and Scandinavian investors – it is scheduled to produce its first batteries by 2023E.

- Britishvolt’s CEO, Orral Nadjari, said that the company is hoping to make its gigaplant “the world’s cleanest and greenest battery facility”.

- Blyth was chosen as the UK’s site for a high voltage subsea interconnector that links the UK to Norway, thanks to its 95-hectare site and deep sea harbour access.

- Blyth also hosts the research base facility for the Offshore Renewable Energy Catapult (the UK’s leading tech centre for offshore wind, wave and tidal energy).

Factories such as Britishvolt’s are crucial in reducing the carbon footprint, especially because of the new regulations banning the sale of combustion vehicles by 2035 in the UK.

The construction of Britishvolt’s gigaplant in the UK will place it in direct competition with Tesla (Nasdaq:TSLA) – by potentially creating the UK’s Electric Vehicle (EV) battery industry. Combine this with the UK’s nascent green metal miners and it begins to look like an EV ecosystem.

Tesla currently owns five gigafactories:

- Giga Nevada (Gigafactory 1) – Storey County, Nevada, U.S.

- Giga New York (Gigafactory 2) – Buffalo, New York, U.S.

- Giga Shanghai (Gigafactory 3) – Shanghai, China

- Giga Berlin (Gigafactory 4) – Brandenburg, Germany

- Giga Texas (Gigafactory 5) – under construction in Austin, Texas, U.S.

As of September 2020, Tesla has begun construction of its largest factory in Europe near Berlin in Grünheide, Germany – completion expected mid-2021. The factory plans to build 500,000 electric vehicles per year and create 12,000 new jobs.

Given that the UK’s 2035 car ban is looming, demand for EVs and gigafactories is expected.

To date, excluding Britishvolt, the UK has one smaller gigafactory in Sunderland that was built in 2010. In addition, the UK boasts expertise in battery research at its universities.

So while Brexit may create hesitation for those considering building gigafactories in the UK, the expectation is that EV products will be exported elsewhere other than Europe.

The potential is for the UK’s EV battery industry to compete internationally with global giants. The UK has the chance to be a leading player in an established but young industry with incredible growth potential.

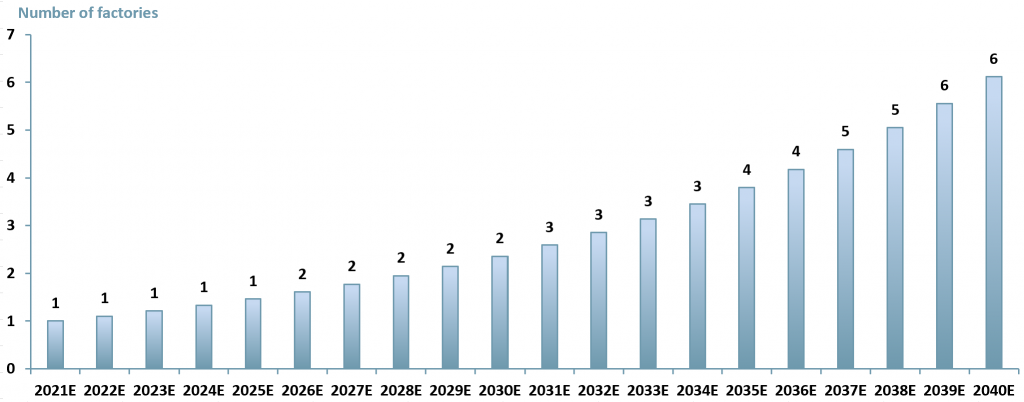

According to The Faraday Institution (UK’s independent institute for electrochemical energy storage R&D) the demand for gigafactories will reach 8 UK factories by 2040. Given the potential constraints of Brexit, we forecast that the number of factories will reach 6 by 2040E, a CAGR of 10% (exhibit 1 below).

Exhibit 1 – UK gigafactory forecast 2021E – 2040E

Sources: ACF Equity Research; The Faraday Institution

Sources: ACF Equity Research; The Faraday Institution

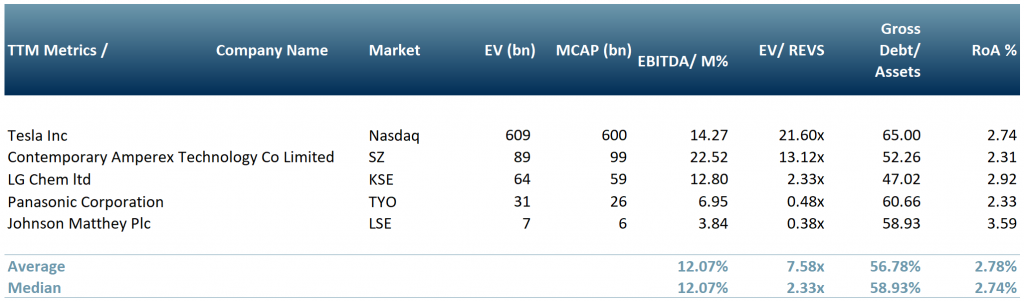

In exhibit 2 we have selected a peer group of the global giants in the EV battery industry – Tesla (Nasdaq:TSLA), China’s Contemporary Amperex Technology (SZ:300750), LG Chem (PKC:LGCLF), Panasonic (OTC:PCRFY) and Johnson Matthey Battery Systems (LSE:JMAT).

Exhibit 2 – Peer group table of EV global giants

Source: ACF Equity Research.

Source: ACF Equity Research.

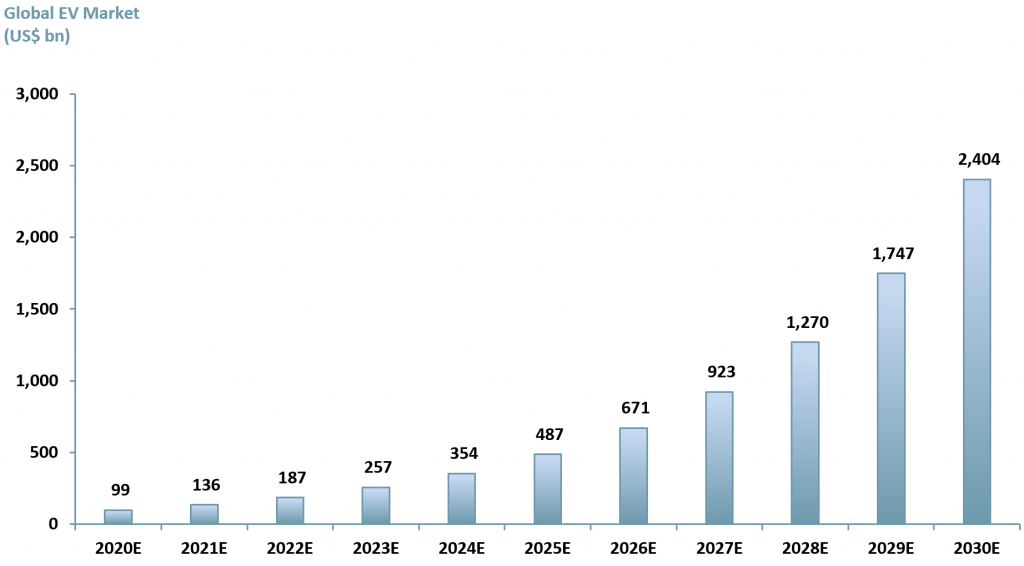

According to Fortune Business Insights, the global EV battery market size is projected to reach US$ 82.20bn by 2027E up from US$ 71.83bn in 2019A, exhibiting a CAGR of 6.6% during the forecast period.

ACF forecasts that in the next ten years the global EV battery market size could reach US$ 2.404trn by 2030E at a CAGR of 37.6%, due to the 2035 ban of new combustion vehicles, as presented in Exhibit 3 below.

Exhibit 3 – Forecast values for the global EV market 2020E – 2030E

Sources: ACF Equity Research; BIS Research; Fortune Business Insights.

Sources: ACF Equity Research; BIS Research; Fortune Business Insights.

Author: Anda Onu – Anda is part of ACF’s Sales & Strategy team. See Anda’s profile