Oil & Gas: time for reform?

Irrespective of recent price support through OPEC production cuts, demand for oil continues to slump as a result of Covid-19.

As is well discussed over at least four decades O&G producer countries need to diversify their economies – if not quite at the beginning of the end of the road, it is clear now that the carbon energy game is approaching its sunset years.

There are still significant returns to be made in oil and gas, but investors are already beginning to abandon the oil and gas sub-sector in favour of renewable energy plays. Those investors that remain will become specialist and highly selective. The accepted conundrum is as follows

- When oil prices are low, demand increases, however producers are then unable to afford economic reforms due to lower revenues.

- On the other hand when production output falls due to increased demand, the oil price rebounds and producers face less pressure to reform their economies.

Now there is a new factor – renewable energy on the verge of a mass solution for the energy consistency problem – Li-ion battery technology advances for EVs for transport and flow battery technologies for electricity grid energy.

Has the window of opportunity passed for oil producing countries to diversify their economies? For some, yes.

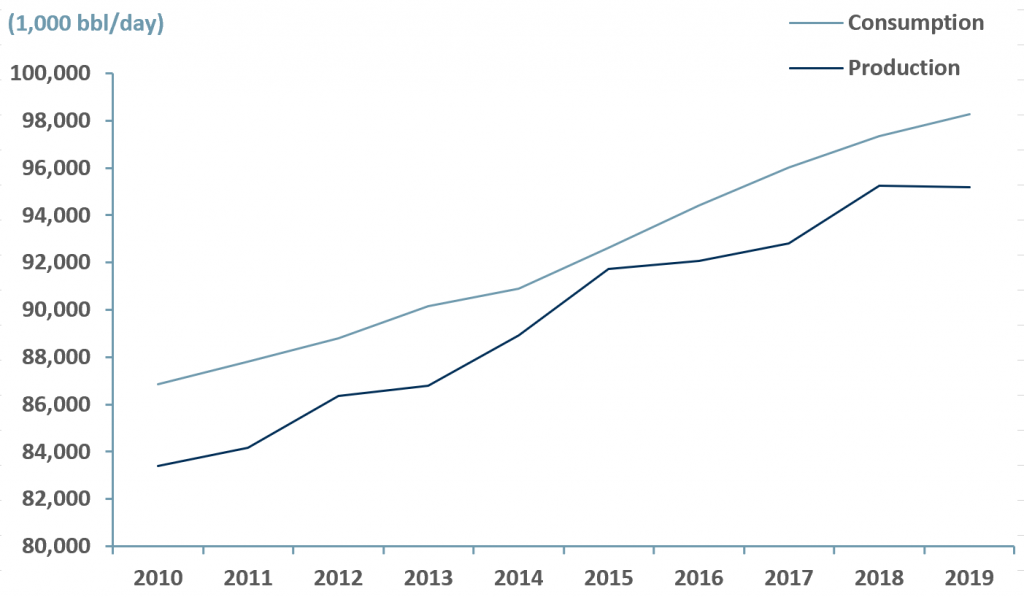

In exhibit 1 below, we describe the relationship between the supply and demand for oil over a 10-year period. Historically, consumption of oil has always surpassed production – hence the creation of, and reliance on, reserves.

However, demand for oil is expected to reduce as a result of and for the duration of the pandemic, and if the pandemic ends up as the new status quo (and we think there are a few reasons it might), what will oil producing companies and countries do for revenues and to balance the books? Has C-19 caused irreversible damage?

Exhibit 1 – Oil global consumption vs. production 2010-2019

Sources: ACF Equity Research; BP

Sources: ACF Equity Research; BP

According to an article in the Economist from 17 Nov. 2020, the window of opportunity for oil producing countries in the Middle East to diversify their economies, is still slightly ajar. We don’t wholly agree with The Economist. For some countries and companies there is no longer enough time for them to adjust their cultures and develop the will to change and innovate (based upon past performance).

The ten leading oil producer countries have relied heavily on oil revenues for decades but given the oil price conundrum, things have to change.

In order to increase revenues and cut spending, the Middle Eastern oil producers have adopted some drastic measures as listed below:

- Saudi Arabia, the world’s second largest oil producer after the US, and the Middle East’s largest producer, increased its value-added tax (VAT) by 3x to 15% in 2019.

- In addition, Saudi is forcing migrants out of the public sector (i.e. labour market government jobs generally in construction, etc. that are lower paid) in order to reduce costs and free up jobs for Saudi citizens.

- The United Arab Emirates (UAE) is expected to decrease its job force by ~1m migrants by the end of 2020 (1/10th of its population) as a result of salary and job cuts.

- Kuwait plans to enter the global bond market in order to adjust its federal deficit that is currently worth 15% of its GDP.

- Iraq plans to cut public spending for its 2021 budget by basing it on an oil price of $42/bbl vs. the less conservative $56/bbl used for its 2019 budget. (2020 budget is still pending but an emergency bill was passed in order to cover the deficit as a result of low oil demand.)

- Algeria’s foreign reserves are expected to fall to US$ 44bn in 2021, compared to $200bn in 2014 as a result of being forced to devalue its currency due to decreased demand for oil.

Petrodollar countries, in particular Arab countries whose economies are significantly dependent on oil, seem to be in the last chance saloon so far as using oil revenues to diversifying their economies is concerned.

Saudi Arabia and other oil producing countries have lived on a constant sense of security and optimism in regards to their abundant oil reserves.

The pandemic has been yet another wake-up call – if one were needed – for swift and effective policy change.

As one of the biggest players in the O&G sector, and de-factor leader of OPEC, Saudi it can be argued, is taking the lead before it has no choice.

Reforms take time to be tested and implemented. Rushed decisions around complex situations are not productive. Large key players need to lead by example.

While damage control has been essential as a result of Covid, it is not a long-term solution. The reality of the O&G industry is, in fact, less optimistic. Oil prices will stay low as demand remains weak in the near-term, and investors are flocking to renewable energy at the expense of fossil fuel companies.

Saudi is an energy market expert. It also has a vast solar resource in the form of its deserts, recent innovations in power transmission suggest it can get energy to the heart or close to the heart of Europe, battery technology innovations that can store vast amounts of energy for utilities are in commercial beta phase.

No one should rule out Saudi as a dominant global energy producer at this time. It has everything needed to switch sources successfully to renewables (solar) and the technical puzzle is essentially solved. The rest is down to Saudi. And what is true of Saudi is true of many other OPEC producers and the US.

Author: Anne Castagnede – Anne leads the Sales & Strategy Team at ACF Equity Research. See Anne’s profile here