Can the UK beat the 2050 emissions target?

UK energy companies are asking the government to set a new target for net zero emissions prior to the 2021 UN COP26 summit. The current emissions target is 2050.

- Following the US pledge to decarbonise its power sector by 2035, BP (NYSE:BP), Royal Dutch Shell (NYSE:RDS-A), National Grid (NYSE:NGG), SSE (SSE.L:LSE) and Drax (DRX.L:LSE) are lobbying Boris Johnson to match the US pledge.

- Sector specialists believe that a 2035 target is optimistic. Analysts, on the other hand, are more interested in how the targets are achieved and at what cost.

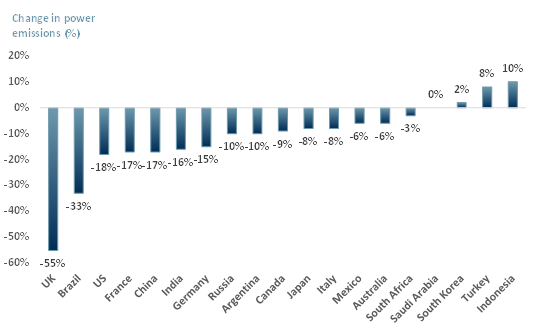

- Even though the UK is leading the world in decreasing power generation CO2 emissions (Exhibit 1), the underlying concern is not about reaching the net zero target – it is about the policies currently in place.

Exhibit 1 – Global change (%) in electricity carbon intensity between 2013-2018

Sources: ACF Equity Research Graphics; Climate Transparency

Sources: ACF Equity Research Graphics; Climate Transparency

- Boris Johnson has already set out a green energy plan to reach the 2050 net zero emission target. In addition, the sale of new petrol and diesel cars will be banned after 2030.

- Energy companies are hopeful that the release of the long-awaited white paper in the next few weeks, will provide some clarity. Advisors will also decide in more detail how the UK can reach its 2050 target.

In our view, given that the UK is leading the world in decreasing power generation emissions, it could match the US’s target of 2035.

By coordinating timelines, the two governments can support each other towards the 2035 finish line.

The UK has already implemented the green energy plan as well as certain measures in different parts of the economy. However, a detailed action plan is needed.

The overall sentiment of energy companies is that there is a lack of clarity as to how and what tools/resources will be needed in order to meet the 2050 target. The UK government plans to provide details soon.

In addition, if small and mid-caps companies join in with the top five in pledging to bring forward the 2050 target, it could have a stronger impact.

The opportunity for small and mid-caps companies would be to embrace this inevitable change as early as possible.

The earlier companies start incorporating sustainable business practices, the more credible they will be as investment decisions.

Investors, institutional and retail – in particular SHNWI millennials, are drawn to companies that have excellent due diligence procedures and are transparent.

They are environmentally conscious and want to make sure their funds are being invested accordingly.

Embracing these changes as soon as they arise as opposed to reacting to them will make all the difference for small and mid-caps.