How Blockchain can transform mining

Mining companies small and mid-cap must follow their mega and large cap cousins and add blockchain to their strategy – here is why.

Where did blockchain come from:

Blockchain was introduced in 2008 as a part of the bitcoin project – a decentralised digital currency that provides a currency that is independent from traditional banking institutions. Each block is linked to the previous one and contains transaction data, ergo creating a chain.

How does block chain work:

Blockchain data cannot be modified or deleted. Network participants setting up a new block of transactions, must agree that it is valid via a consensus. Once agreed, the block is given a timestamp and a cryptographic hash (mathematical algorithm). New transactions can be created, but they are added to the chain as a new block while original data remains accessible and unmodified.

How can mining companies deploy blockchain usefully:

This means that if the transaction involves an asset or a commodity for example a mined unprocessed ore or a processed metal, blockchain provides information on the provenance, e.g. ownership, geographical location, where it is in the value and or supply chain, etc.

As a result, there is an increasing interest in blockchain in the mining industry, especially at a time when the industry is under scrutiny as a result of its environmental efforts, or perceived lack thereof. Investors and governments are insisting on higher standards. Blockchain also has the capability to reduce fraud and cut operational costs.

Characteristics of blockchain that make it useful for mining companies:

- Blockchain encryption technology is already a crucial tool in the currency digitization process, enabling its decentralization and most importantly, reinforcing transparency to the user or verifier and or protecting privacy.

- Blockchain technology can be used in many industrial sectors including mining, retail, agriculture, transport, tourism, and healthcare.

- Transparency in the mining industry is very much sought after from stakeholders. Transparency can prevent corruption; enables material traceability and changes the culture of a business by showing accountability.

Why does ACF Equity Research assess that blockchain is important for the mining industry?

The mining industry continues to face a range of challenges, including those driven by the Covid-19 pandemic. Global environmental targets are around the corner and there is current and long-run increased demand for critical minerals in green technologies.

In our view, environmental targets and increased critical minerals demand are triggers that should encourage small and mid-cap mining companies to invest in blockchain as part of their entire cleantech strategy, in order to promote transparency and sustainability, in order to maximise returns. The speed at which mining companies do this will be key for investor returns.

While implementing blockchain technology is a long-term investment, we think that it is timely and offers solutions that can enhance productivity, compliance, reduce fraud and perhaps more importantly, improve control and monitoring of the supply chain (examined in more detail below).

Prices for metals and minerals are on the rise – at ACF Equity Research we assess that we have entered a new commodity super-cycle. Therefore, we infer that mineral rich countries and companies based there will have more economic deposits and opportunities to negotiate on their terms.

Being prepared for what investors and stakeholders want to see will make the difference and allow mining companies to seize upcoming market opportunities.

Where can blockchain be used in mining operations?

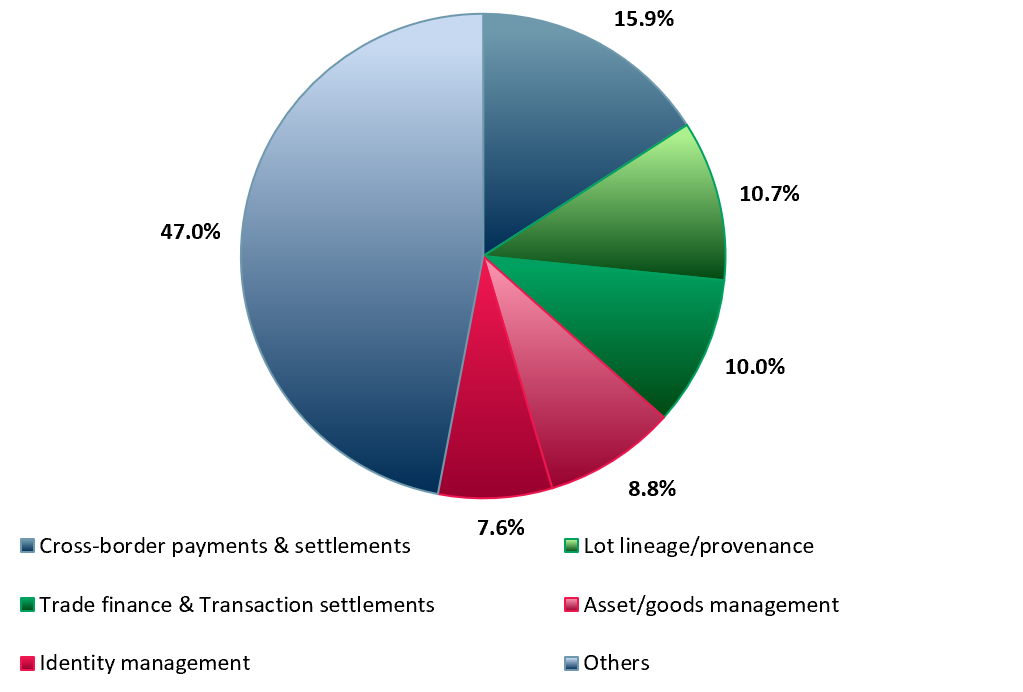

Blockchain technology’s top three primary uses (based on spend) are cross-border payments and settlements (15.9%) followed by lot lineage/provenance (10.7%) and trade finance and post trade/transaction settlements (10%) – Exhibit 1. The three of these uses are essential to the mining industry.

Cross-border payments – Transaction speed is one of blockchain’s primary assets. Blockchain also eliminates the need for a ‘middleman’.

Provenance – Ownership, geographical location and where the asset or equipment is in the value chain is essential for business productivity but also for investor interest.

Trade finance – Improve and increase the speed of financing needed for business operations.

Exhibit 1 – Blockchain technology market share by use, 2021E

Sources: ACF Equity Research Graphics; IDC; Note: The 47% Other refers to anything that is not related to IT/business/financial services, i.e. crypto exchange, medical data storage, prevention of voter fraud, etc.

Sources: ACF Equity Research Graphics; IDC; Note: The 47% Other refers to anything that is not related to IT/business/financial services, i.e. crypto exchange, medical data storage, prevention of voter fraud, etc.

Blockchain can benefit the mining industry to improve productivity and support the supply chain in the following ways according to Wipro (WIT:NYSE) and IBM (IBM:NYSE):

- Compliance – Every region has its own set of rules and regulations that govern the mining industry, with some commonalities across borders. These include regulations on mining activities, as well as the conservation of natural resources, protection of the environment and the liability of the company.

The use of blockchain technology would promote and enhance compliance by improving traceability of reserve estimates for stock exchanges and financial year-end reporting.

- Lease management and permits – Blockchain would facilitate the use of smart contracts and efficiency of document approval in relation to exploration, estimates, mine design and planning.

Obtaining building and land permits is an exhaustive process in the industry. As we enter a new digital normal where critical management teams may not be on the ground, blockchain could facilitate the movement of information to expedite approvals.

- Original Equipment Manufacturer (OEM) – Mining companies source equipment and spare parts from multiple vendors and in most cases, it is only the OEM that is aware of who is who. Through blockchain transactions the mining company would have access to the original vendor.

It would also help with identifying a piece of equipment, immediately being able to identify what spare parts are needed and therefore assist maintenance teams to resolve issues more efficiently.

- Mineral/metal provenance – End users of minerals and metals are becoming more concerned about whether or not assets are ethically sourced. Apple (NASDAQ: $AAPL) does not source its raw materials from conflict zones, or from mining companies who do not have social or environmental standards.

DeBeers, developed Tracr, a blockchain platform to regulate its supply chain management system. It can track any size of diamond from the mine directly into the store, guaranteeing that the diamond is authentic and ethically mined. The Kimberley Process was established in 2003, it is a certification scheme that prevents ‘conflict diamonds’ from entering the diamond market.

ACF Equity Research view on investment returns in blockchain in mining:

The above list is certainly not exhaustive in terms of how blockchain benefits the mining industry. Larger players in the industry are already leading the way. See the example below.

BHP Billiton Limited, (NYSE: $BHP), a mining company headquartered in Australia, completed its first iron-ore blockchain trade with Boashan Iron & Steel Co. Ltd (600019.SS) in 2020 for US$ 14m. $BHP used Canadian based Minehub Technologies Inc. ($MHUB.V) to speed up the delivery of documentation pertaining to the samples collected and the digital processing of the contract terms.

Blockchain offers an array of opportunities in the mining industry and if implemented at the right time (i.e. now), it could turn into a powerful tool and provide smaller and mid cap mining explorers and producers (E&P) with a competitive advantage from an investor perspective.

Blockchain also presents opportunities for providing transparent verification of ethically responsible mining, in line with environmental targets and nurture trust and transparency. Investors that might currently eschew or question mining techniques and business operations are also likely to be satisfied, thereby broadening the pool of capital available to the small and midcap explorers and producers in the mining sector.