The way forward: Climate-Smart Mining

The World Bank launched its Climate-Smart Mining fund in 2019 – the first of its kind dedicated to mining. Climate-Smart Mining assists and supports countries in implementing sustainable strategies in mining operations.

The global economy is in the process of transitioning to low carbon technologies such as wind turbines, solar panels and battery storage, much of which is driven by the need to fight climate change.

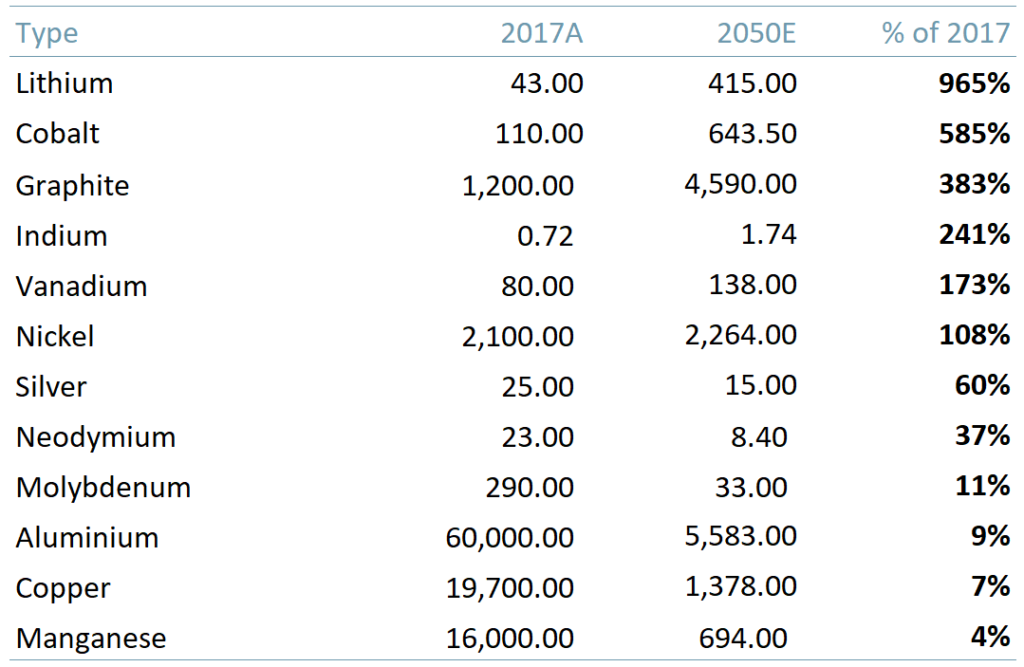

However, these technologies require large amounts of metals and minerals. Minerals needed to convert to a green or renewable energy system include graphite, lithium and cobalt. Demand for green metals for use in cleantech could increase by more than 350% in 2050E, see exhibit 1 (IEA Energy Technology Perspectives).

Exhibit 1 – Global mineral demand from green technologies 2017A & 2050E

Sources: ACF Equity Research Graphics; IEA Energy Technology Perspectives 2017

Sources: ACF Equity Research Graphics; IEA Energy Technology Perspectives 2017

- ~3 billon people live in resource rich countries, but everyone can benefit from the green metals energy transition, especially developing countries.

- Countries such as the Democratic Republic of Congo, India and Peru would benefit from new job creation, improving corporate and local infrastructure and boosting government revenues.

- Challenges will remain / emerge if the green energy transition is not manged responsibly or sustainably.

Mining accounts for 11% of global energy use, which means that the industry currently has a significant environmental and social impact. Hence the increasing emphasis on mining companies transitioning to energy such as hydro and green hydrogen to power their operations e.g. Fortescue Mining

Climate-Smart mining

Climate-Smart Mining is a World Bank and global partnership initiative that supports the responsible extraction of minerals and metals while minimising the carbon materials footprint. From extraction to end use, every step is part of a holistic approach and incorporates the following:

- Climate-change mitigation – Avoiding and reducing greenhouse gas (GHG) emissions into the atmosphere.

- Climate-change adaptation – Adapting a business’s infrastructure to adhere to safe building codes to off-set natural disasters and reduce pollutants.

- Reduction of material impacts – Reducing, reusing and recycling materials in order to reduce GHG emissions, sustain the environment and lower operational costs.

- Creation of market opportunities – Global investments in climate-friendly funds are increasing and developing countries are offering investment opportunities for new construction and infrastructure projects.

Global sustainability standards and increased transparency

Governments, investors and mining companies and end users of renewable technologies are beginning to work together to ensure low carbon technologies are built in a sustainable way.

Governments and investors with a sustainability/ESG agenda will be more inclined to support a Climate-Smart Mining industry and smaller companies who show they are on the path towards sustainability.

There is an increasingly well-argued line of thought that all three ‘estates’, governments, investors and corporates will need to work together to attain climate and energy transition goals.

In 2003 the Extractive Industries Transparency Initiative (EITI) was created. It is a global standard supporting governance and transparency of mineral, oil and gas resources. The EITI Multi-Donor Trust Fund (MDTF) is administered by the World Bank.

The MDTF provides grants and technical assistance to countries to assist with implementing EITI principles focusing on reforms, improved transparency, and accountability. As of Jan 21 there were 55 member countries – each country undergoes a ‘Validation’ process and is given a score out of 100 for each of the three components:

- Stakeholder engagement – The participation of constituencies and multi-stakeholders in implementing EITI principles.

- Transparency – Whether or not a country meets the disclosure requirements of the EITI.

- Outcomes and impact – How EITI requirements are implemented and what progress is evident in a country’s efforts to address national priorities.

The Climate-Smart Mining concept, policies and instruments was created following years of work the World Bank carried out to encourage and support resource-rich developing countries to mine sustainably and foster economic growth.

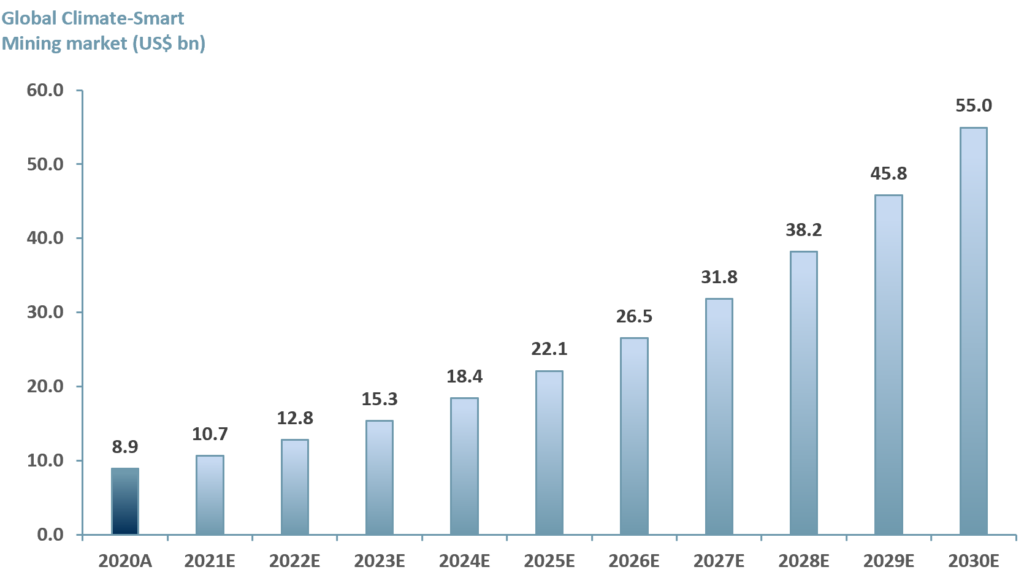

The World Bank funds and other funds that have been launched since are increasing investment flow into cleantech / green tech. We infer that the Climate-Smart Mining market growth rate will accelerate in the medium to long-term.

The smart mining / climate smart mining market refers to the market for the use of data, autonomy and technology in mining.

ACF forecasts that the value of the smart mining market will reach US $55bn by 2030E, up from $8.9bn in 2020A – a CAGR of 20% (exhibit 2). Our forecast is slightly less conservative than current market consensus given the urgency to meet the Paris Agreement targets by 2030 to limit global warming levels to below 2°C.

Exhibit 2 – Global Climate-Smart Mining market 2020A-2030E

Sources: ACF Equity Research Graphics; Mordor Intelligence

Sources: ACF Equity Research Graphics; Mordor Intelligence

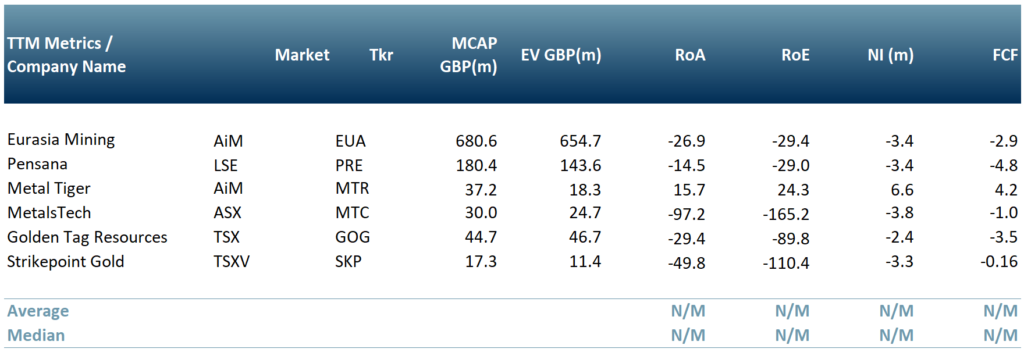

In Exhibit 3 below, we have selected a peer group of five minerals and metals producers that currently incorporate cleantech in their business operations: Pensana ($PRE.L), Metal Tiger PLC ($MTR.L), MetalsTech Ltd (ASX: $MTC.AX), Golden Tag Resources Ltd. (TSX : $GOG.V and Strikepoint Gold Inc. (TSX : $SKP.V).

Exhibit 3 – Peer Group of mining companies currently using cleantech

Sources: ACF Equity Research Graphics; Refinitiv; Exchange rates: (Source: XE.com); CAD vs GBP 0.5769; AUD vs GBP 0.5377; USD vs GBP 0.7230

Sources: ACF Equity Research Graphics; Refinitiv; Exchange rates: (Source: XE.com); CAD vs GBP 0.5769; AUD vs GBP 0.5377; USD vs GBP 0.7230

The companies in the peer group have at the very least a Corporate Social Responsibility (CSR) statement, some have much more. From the CSR policy starting point it is relatively low-hanging fruit to produce an ESG policy statement with metrics, just about in time to make the most of the upcoming capital market opportunities.

We believe that for small and mid-caps companies especially in the mining industry, having a strong ESG policy statement with metrics (and in the process being cautious to avoid any form of greenwashing) will resonate strongly with investors, change the company culture by promoting transparency and accountability.

In addition, through the internal discipline of ESG plus metrics, we assess that FCF margins can and do rise, and that gains in improved market sentiment for small to mid-cap mining explorers and producers will increase their valuations.

Author: Anne Castagnede – Anne leads the Sales & Strategy Team at ACF Equity Research. See Anne’s profile here

If you would like more information on ESG / Sustainability and how ACF can help please contact Renas Sidahmed. Renas is Head or our ESG / Sustainability valuation products and services https://acfequityresearch.com/contact-us/ or email her at rsidahmed@acfequityresearch.com