Tesla fair value – car manufacturer or gigafactory?

Tesla (NYSE:TSLA), an Electric Vehicle (EV) manufacturer and developer, delivered a 4Q20A revenue beat but missed net income expectations. Some investment research firms believe competitors will take market share from Tesla in the growing EV market.

Key points:

- As of 25 Feb 2021 Tesla’s enterprise value stood at US$ 650bn, up 8x vs. US$ 79.9bn at the beginning of 2020.

- Tesla 4Q20A revenues came in at US$ 10.74bn up 1.97bn or 22.5% vs. 8.77bn q/q, and net earnings 239m down 92m or -27.8% vs. 331m q/q. Tesla beat market consensus for its 4Q revenues but missed expectations for its 4Q net earnings.

- Tesla relied heavily on the sale of regulatory credits to boost 4Q20A net earnings.

- Following Tesla’s results release on 27 Jan 2021, its share price closed down ~10% at US$ 793.53 by 29 Jan vs. US$ 883.09 on 26 Jan.

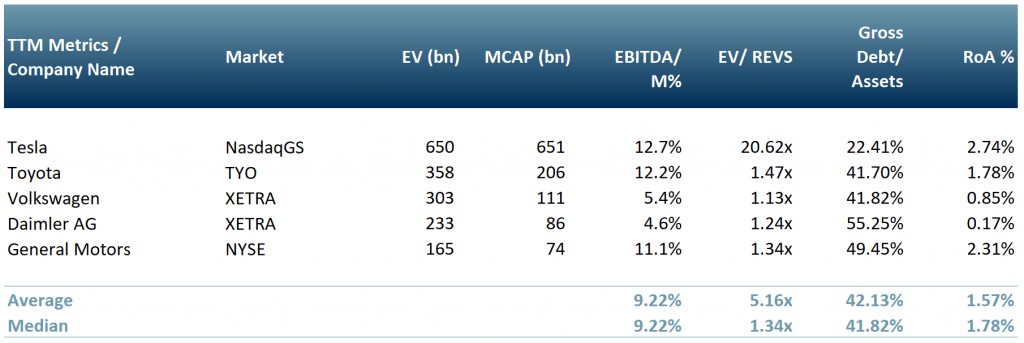

- Tesla’s EV/REVS (enterprise value to revenues) at 20.62x is ~14-18x higher than its peers. (exhibit 1)

Tesla had an excellent FY20A. Its share price increased to US$ 705.67 on 31 Dec 2020 up 8x or 720% from US$ 86.05 on 2 Jan 2020. TSLA managed to create a positive annual net income for the first time of US$ 721m.

As of 24 Feb 2021, Tesla had an enterprise value of nearly double that of its closest competitor (Toyota Motor Corporation (7203:TYO)) standing at US$ 650bn versus US$ 358bn for Toyota.

Exhibit 1 shows a peer group of the top five car manufacturers ranked by enterprise value – Tesla (NYSE:TSLA), Toyota Motor Corporation (7203:TYO)), Daimler (DAI.DE:XETRA), Volkswagen AG (VOW.DE:XETRA) and General Motors Company (MYSE:GM).

Exhibit 1 – Peer group table of the top five vehicle manufacturers by enterprise value

Sources: ACF Research Graphics; Yahoo Finance

Sources: ACF Research Graphics; Yahoo Finance

Is Tesla’s high enterprise value justified?

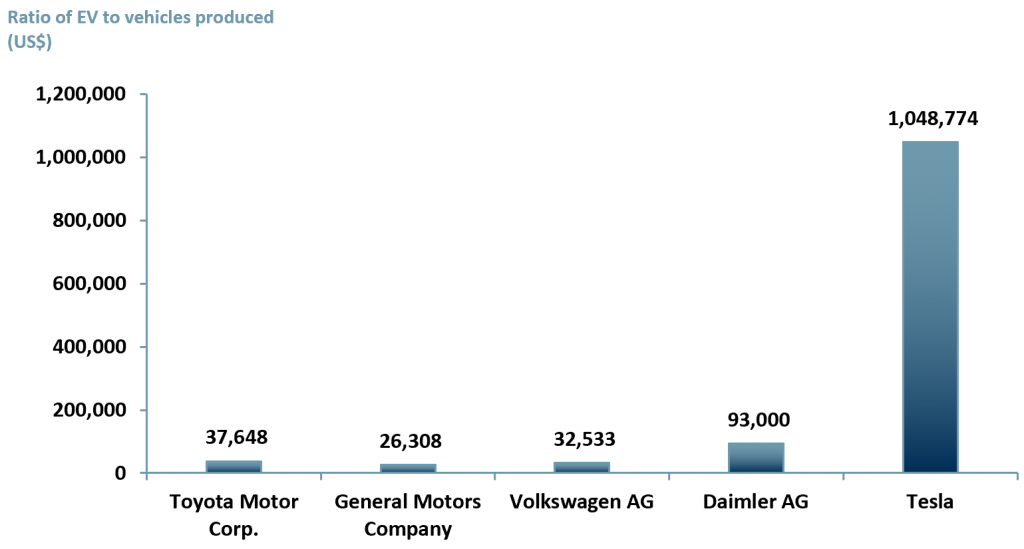

In FY20A, Tesla produced ~0.62m vehicles, a YOY increase of 71%. However, the more expensive Model S and X decreased in sales by 10% YOY. TSLA’s EV/REVS currently stands at 20.62x.

Toyota is the second largest auto manufacturer by EV at US$ 358bn. Across all Toyota’s brands (Toyota, Lexus, Scion, Daihatsu, Hino), the car manufacturer produced ~9.5m vehicles.

Toyota’s EV/REVS YE20A stood at 1.47x. This suggests investment analysts and investors are assigning US$ 37,684 per vehicle manufactured. For TSLA, the equivalent value per vehicle manufactured assigned by the market is US$ 1,048,774. It seems difficult, on face value, to conclude anything other than Tesla is somewhat over-valued by the market.

Exhibit 2 below shows the value of the top five vehicle manufacturers as a ratio of enterprise value to vehicles sold and highlights the extreme premium that is being put on Tesla’s share price on a per car manufactured scale.

Exhibit 2 – Ratio of enterprise value to vehicles sold of the top five vehicle manufacturers by enterprise value 2020

Sources: ACF Equity Research Graphics; Tesla; FT; Daimler; Focus2move

Sources: ACF Equity Research Graphics; Tesla; FT; Daimler; Focus2move

Unlike its competitors, Tesla is more than just a car company. Tesla is also, and perhaps primarily, a renewable power company. Tesla has announced it will make its own rechargeable car batteries (a new business line). TSLA already provides solar panels for power generation to homes and businesses as well as battery storage packs. Its solar business has grown ~60% YOY, and its battery arm by ~200% YOY.

Its autonomous vehicle software also shows promise and is already included in all of its new cars. However, its autonomous vehicle software will remain very limited until the technology is proven to be safe.

Although more than a car company, all of Tesla’s net income for YE20A came solely from its Electric Vehicle business and in particular from its automotive regulatory credits business – bringing in ~US$ 1.6bn vs.Tesla YE20A net earnings US$ 721m.

YE20 was the first year in which Tesla managed to create a net profit over the 12-month period – the company has had to rely on the sale of regulatory credits to lift earnings. Regulatory credits (or points) are given by the state or federal government to companies that contribute towards net-zero emissions.

Regulatory credits are an incentive for auto manufacturers to produce EVs in the US. Each year, auto manufacturers must sell a minimum number of EVs or acquire a minimum number of credits. As Tesla only produces EVs, it is awarded excess credits, which it can then sell to other auto manufacturers.

Many major auto manufacturers are now investing heavily in the EV sector to try and capture a significant share of the growing market. This in turn is tightening the rechargeable battery supply market. Tesla is currently purchasing the maximum number of batteries that its suppliers (CATL (300750.SZ), Panasonic (6752:TYO) and LG (066570:KSE)) can sell to it.

By 2025E, GM (NYSE:GM) plans to invest US$ 27bn in EVs and Toyota is due to release plans to use solid state batteries in a new line of EVs this summer. Toyota claims its battery competitive advantages includes characteristics such as 6x faster charging times and improved battery life over traditional Lithium-ion batteries used in EVs.

Along with the increased demand for batteries, the prices of raw materials have been increasing. Benchmark Mineral Intelligence (a price reporting company) estimated that in Dec 2020 alone battery specification graphite increased in price by 13.2% with cobalt and lithium up by 13% and nickel by 6.4%.

However, in Feb 2020 Tesla confirmed that it would manufacture its own car batteries. Tesla is planning a so-called gigafactory with Panasonic to bring its EV battery manufacture in-house. Tesla is planning to exclude cobalt from its batteries. Tesla also aims to produce and sell a $25,000 car.

The EV battery market is expected to grow by US$ ~44bn between 2021E – 2024E, Tesla was expected to face more competition to acquire batteries as other manufacturers scale up their EV production. (Market Reports World, 2020). But Tesla’s gigafactory plans go a long way to undermining that investment research concern.

On 24th December 2020 we suggested that Tesla might not be fully valued on our high end assumptions with an implied EV/REVS of 1x. Tesla’s enterprise value has since risen to US$ 650bn implying an EV/REVS of 1.4x in our investment research high end case – more or less in line with current peer EV/REVS. In our base case Tesla scenario we forecast revenues in YE30E of US$ ~100bn, up from US$ 31.5 bn in YE20A.

We expect Tesla will remain a dominant player in the EV market – currently at ~18% market share of a growing market – but our valuation approach is suggesting that Tesla is close to full valuation…for now.

Authors: Sam Butcher and Christopher Nicholson – Sam is a Junior Staff Analyst at ACF Equity Research, Christopher is a founding executive, MD and Head of Research at ACF Equity Research. See their profiles here