UK electric vehicle ecosystem

Stellantis, announced a £100m investment in UK manufacturing of electric vans on 06 July 2021. Ellesmere Port’ s electric vans factory is part of a government financial deal.

- The carmaker Stellantis (NYSE: STLA) is a merger of Peugeot, Vauxhall and Fiat Chrysler. Stellantis intends to make an electric version of Vauxhall and Opel combo vans.

- Stellantis plans to start manufacturing the EV vans at its Ellesmere Port factory from 2022. The UK government has offered £30m as financial support towards the Stellantis project.

- Stellantis’ investment follows Nissan’s £1bn announced plan to build its own UK EV model and the first gigafactory in the country – eventual capacity 35GWh. Initially, Stellantis wants to import batteries with plans to use those produced nationally soon – if more affordable.

The investment interest in the UK EV and batteries market will increase. The Nissan and Stellantis investment plans offer the country a good starting point for a business ecosystem that could become global leader for both EV cars/vans and batteries production.

According to Research and Markets, the global electric van market is expected to grow by 151.72k units by early 2024. So, Nissan’s plan to have a gigafactory (batteries) in the UK will complement the emerging UK battery/EV market. This is just as well as the UK is effectively in a race with the rest of Europe to create these industrial ecosystems.

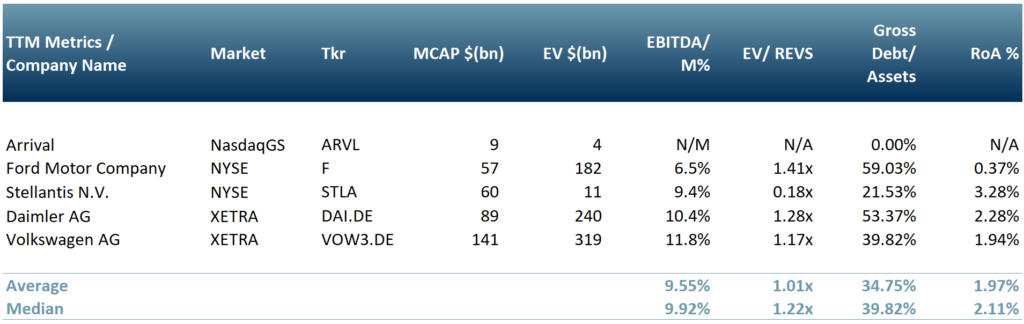

Besides Stellantis, the global electric vans market key scale players include Daimler AG (DAI.DE: XETRA), Ford Motor Co (NYSE: F), Renault SA (RNO: PA), Toyota Motor Corp (NYSE: TM) and Volkswagen (VOW3.DE: XETRA). Arrival (ARVL: NasdaqGS) is a smaller start-up EV vans and buses producer. See our peer group of Tesla (NasdaqGS: TSLA) competitors in Exhibit 1 below.

Tesla has indicated that it plans to enter the ‘electric vans’ market at some point but is reserved about timing guidance for now due to a global battery cell shortage. Tesla’s CEO, Elon Musk, has yet to express a specific commitment to the UK EV manufacturing and battery market.

Exhibit 1 – Peer Group of Electric Vans producers

Source: ACF Equity Research Graphics; Notes: Exchange Rate: (Source: XE.com); EUR vs USD: 1.1858

Source: ACF Equity Research Graphics; Notes: Exchange Rate: (Source: XE.com); EUR vs USD: 1.1858

UK battery and EV market ecosystem drivers

The recent surge in home deliveries has increased the demand of vans by the logistics sector (the UK’s 3rd largest business ecosystem). Every sign is that this growth in logistics will persist along with C-19 and beyond.

Tech – there are a raft of technologies from autonomous vehicles to flying cars to drone delivery logistics under development that successful or not will only serve to highlight and increase consumer and political appetite for home delivery and logistics investment.

Demand growth – delivery companies seem focussed on increasing all aspects of their fleets including EV – the transition to electric in logistics in the UK is well under way.

Amazon (NasdaqGS: AMZN) intends to have a fleet of at least 100K electric vans produced by Rivian. According to its ‘Climate Pledge’, Amazon wants its fleet to become zero net carbon by 2040.

Fedex (NYSE: FDX), another significant logistics firm, currently has a fleet of 200K vehicles and intends to replace these in less than two decades – probably with electrics. FedEx issued a purchase order of 500 electric vans from General Motors (NYSE: GM)’s BrightDrop in 2021.

United Parcel Service, Inc (NYSE: UPS), another logistics giant, ordered 10K electric vans from London start-up Arrival (NasdaqGS: ARVL), in 2020. UPS might purchase another 10k electric vans in the near future from Arrival.

Germany based Hermes Group, another large logistics business, with significant markets in the UK, France, Austria, Italy and Russia as well as Germany, partnered with Ford Motor to replace its fleet with both electric and autonomous vehicles.

Environment – Climate change effects constantly attracted new headlines, and, so we argue, political attention. For example, Canada’s 1 in 1000 year recent ‘heat dome’ event, in which the small town of Lytton experienced record a Canadian temperature of 49.5⁰C…and pretty much immediately burned to the ground.

The UK opportunity – Though Stellantis’ and Nissan’s investment commitments are significant for the future of the UK EV industry and are important strategic developments for the UK market, it is not enough to celebrate without caution at this point.

Ellesmere Port plant’s workforce is currently only at 1,000 out of a full capacity of 12,000. We understand that employees have been told that Ellesmere’s manufacturing space will, at least in the short-run, reduce by 64% for efficiency improvements.

The UK has battery metals in Cornwall and a couple of miners, one of which is listed (Cornish Metals, CUSN.L) and the other (British Lithium), which we currently expect to list via an IPO, could perhaps supply half the UK’s future lithium requirements, but it is all still relatively small scale.

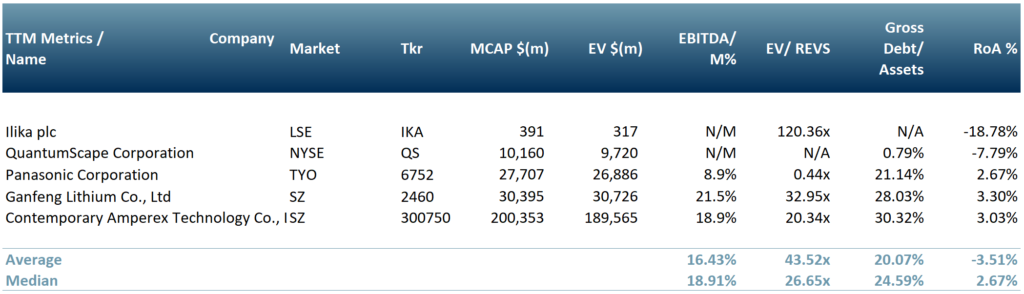

We also have home grown innovative battery technologists, such as public company Illika (IKA.L) about to ramp up production of innovative solid state batteries that are easily and safely recycled. However, Illika, for now at least, is small in comparison to its possible global peers (see exhibit 2 below).

Exhibit 2 – Peer group of public companies producing solid state batteries

Source: ACF Equity Research Graphics; Notes: Exchange Rate: (Source: XE.com); GBP vs USD: 1.3766; CNY vs USD: 0.1541; JPY vs USD: 0.0091

Source: ACF Equity Research Graphics; Notes: Exchange Rate: (Source: XE.com); GBP vs USD: 1.3766; CNY vs USD: 0.1541; JPY vs USD: 0.0091

What we can say about the UK EV market is that, with the Stellantis and Nissan announcements, all the parts appear to be in place – demand, technologies, natural resources, manufacturing and political will – for a potentially very exciting UK growth industry.